Brokers Digest: Local Equities - Axiata Group Bhd, Westports Holdings Bhd, Trc Synergy Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on February 12, 2024 - February 18, 2024

Non-bank financial

NEUTRAL

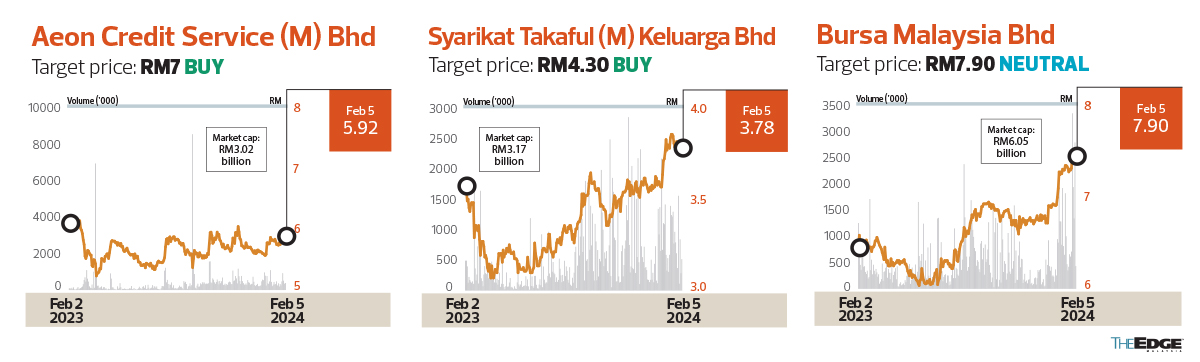

RHB RESEARCH (FEB 5): Sector earnings growth should hold up in 2024, supported by a decent macroeconomic backdrop. We remain bullish on insurers, but are more selective towards non-bank lenders, given the subsector’s mixed risk-reward offerings. We downgrade the sector to “neutral” as we believe valuations have caught up with fundamentals, and advocate a laggard play for the sector. Aeon Credit Service (M) Bhd (ACSM) and Syarikat Takaful Malaysia Keluarga Bhd (STMB) are our top picks.

We expect a moderate year for insurers under our coverage for two reasons: expectations of car sales coming off a record high in FY2023 and moderation in total investment returns in the absence of a low-base effect. Nonetheless, the stabilisation of claims and reinsurance costs as well as a pickup in life insurance/family takaful contributions should enable mid-single-digit bottom-line growth, at the least. Capital upside could come from gradual pricing out of MFRS17 concerns while a yield of 4% to 5% is decent.

Our preferred pick for non-bank lenders is still ACSM for its undemanding valuation (0.9 times book vs 14% ROE) and sizeable presence in multiple states to anchor its growth. While EPS growth will be hindered by start-up losses from its soon-to-launch digital bank, we believe the investment will pay dividends in the medium to long term via new customer acquisitions and cross-selling opportunities.

Bursa Malaysia Bhd’s share price has added 8% since the start of the year and 21% since June 2023. We are neutral on the local exchange. The biggest upside risk could come from better-than-expected securities average daily value while downside risks could come from greater-than-expected operating expenditure.

After a year of compelling share price performances sector-wide in 2023, we believe valuations have caught up with fundamentals. In 2024, we turn to the two laggards, ACSM and STMB. Both are demonstrating healthy fundamentals and possess bright growth prospects [ACSM’s EPS growth: +14% ex-digital bank losses in FY25F (Feb); STMB’s EPS growth: +10% in FY24 (Dec)], but respectively trading at a significant discount to their historical mean valuations. On the flipside, stretched valuations for certain counters present a profit-taking opportunity.

Axiata Group Bhd

Target price: RM3 BUY

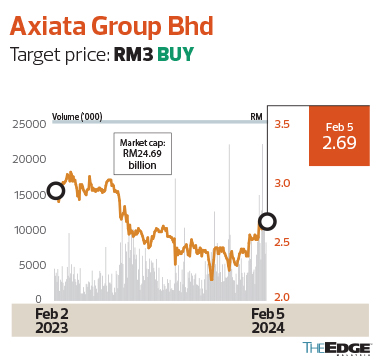

MAYBANK INVESTMENT BANK GROUP RESEARCH (FEB 5): Our simulation indicates that Axiata could come close to achieving its 2.5 times net debt-to-Ebitda target (from 3 times at end-3Q2023) by keeping a simple majority stake in Edotco post equity raising. The percentage of equity issuance that dilutes Axiata’s stake in Edotco and Linknet to the 50% threshold are 26% and 100% respectively. By retaining a slightly above 50% stake in Edotco post equity raising, Axiata’s net debt-to-Ebitda would drop to between 2.4 times and 2.7 times, close to its stated target of 2.5 times (from 3 times at end-3Q2023). Any equity raising at Linknet would provide further balance sheet headway for Axiata. Separately, deconsolidating Edotco or Linknet (without secondary shares transaction) would lower Axiata’s net debt-to-Ebitda to 2.8 times.

Balance sheet leverage is a major overhang for Axiata. We continue to view its overall risk-reward as being positive, with net profit recovery and balance sheet repair being potential rerating catalysts. We reiterate “buy” with an unchanged SOP-based target price of RM3. Axiata remains committed to a DPS of minimum 10 sen annually.

Westports Holdings Bhd

Fair value: RM4.28 BUY

AMINVESTMENT BANK RESEARCH (FEB 5): Westports’ FY23 core net profit of RM779 million was within expectations, coming in 2% above our estimate and 4% of consensus. Management declared a DPS of 8.72 sen in 4QFY23, bringing FY23 DPS to 16.9 sen.

We are cautiously optimistic about Westports’ mid- to long-term outlook, underpinned by a potential tariff hike in 2H24, with implementation in stages from 2025F onwards; Pulau Indah benefiting from supply chain shifts with more distribution and logistics factories being established in the area; stronger growth in regional trade, partially attributed to rising container volumes across China ports, partly mitigated by a soft landing for US economic growth and consumer spending this year; and Westports 2.0 expansion plan to capitalise on regional growth given the port’s strategic position in the East-West Asean trade routes.

We maintain “buy” on Westports with a higher fair value of RM4.28 (versus RM4.27 previously), reflecting an unchanged rolled-forward FY24 PER of 18 times. The stock is currently trading at an attractive FY24F PER of 16 times, below its 5-year average of 18 times, while offering a compelling dividend yield of 5%.

Trc Synergy Bhd

Target price: 60 sen BUY

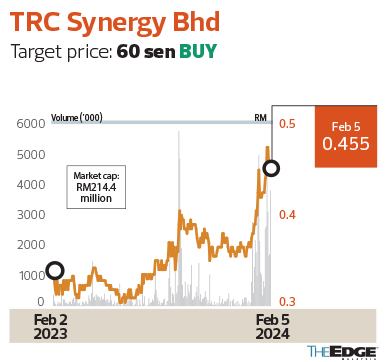

HONG LEONG INVESTMENT BANK RESEARCH (FEB 5): TRC announced an airport project contract win (building refurbishment and infrastructure works at Subang airport) worth RM358 million, lifting its unbilled order book by 71% to RM861.8 million, improving its cover ratio to 1.6 times from 0.8 times previously. No contract timeline was shared.

With infrastructure projects expected to materialise in 2024, TRC could be a beneficiary of this healthier environment. Projects we believe TRC will participate in are MRT3, remaining KUTS (Kuching Urban Transport System) packages, road projects in East Malaysia and airport jobs. We note that Penang airport is also slated for expansion sometime in 2H24.

No change in the forecast for now as MRT3 contract awards remain fluid. With the contract win, our near-term concerns have diminished. We upgrade the stock to a “buy” with a higher SOP-driven target price of 60 sen (from 38 sen) after reducing SOP discount to 40% (from 50%) and imputing higher cash buffers. TRC sits on a net cash per share of 67 sen, exceeding its share price by 47%. At our target price, the stock is trading at FY23F/24F/25F earnings multiple of 23.4/15.2/14 times respectively.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments