Insider Moves: Dolphin International Bhd, M & A Equity Holdings Bhd, SC Estate Builder Bhd, Tenaga Nasional Bhd, Guan Chong Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on April 15, 2024 - April 21, 2024

Notable filings

During the week of April 1 to 5, notable shareholding changes at Bursa Malaysia-listed companies included those at palm oil mill manufacturer Dolphin International Bhd, which saw Datuk Yeo Boon Leong, who is the executive chairman and major shareholder of Asia Poly Holdings Bhd, cease to be a substantial shareholder.

According to a filing with Bursa, Boon Leong sold all of his 10.64 million shares, or a 7.95% stake, in Dolphin in an off-market transaction on April 3.

On the same day, Dolphin executive director Datuk Seri Tan Ooi Han emerged as a substantial shareholder of Dolphin, after acquiring 15.1 million shares in an off-market transaction. Following the acquisition, Tan holds a direct stake of 8.783% and an indirect stake of 5.716% through Oasis Harvest Holdings Sdn Bhd.

Tan continued to mop up more Dolphin shares off market on April 4 and 5, including the 3.14 million, or 2.343% stake, held by non-executive director Yeo Boon Ho in a RM1.14 million, or 36.5 sen per share, off-market transaction. As at April 8, Tan had a direct stake of 9.754% and an indirect stake of 10.206% in Dolphin. Boon Ho and Boon Leong are siblings.

Shares in Dolphin have risen 19% so far this year to close at 21.5 sen last Monday, valuing the group at RM28.1 million. On April 2 this year, it had aborted a proposed rights issue to raise up to RM13.4 million, saying that it intended to explore other more expeditious manner of raising funds for its working capital.

Over at brokerage firm M & A Equity Holdings Bhd, which was listed on Bursa via a reverse takeover of SYF Resources Bhd last year, Siti Nur Aishah Ishak ceased to be a substantial shareholder after disposing of two million shares on the open market on April 3, filings with Bursa show. She now holds a 4.988% stake in M & A Equity — below the 5% threshold required for the substantial shareholding status.

Siti Nur Aishah first emerged as a substantial shareholder of M & A Equity on March 22, after acquiring 101.7 million shares, or a 5.088% direct stake.

Shares in M & A Equity have risen 7% so far this year to last Monday’s close of 36.5 sen, valuing the group at RM721.6 million.

At SC Estate Builder Bhd, chairman and managing director/CEO Loh Boon Ginn re-emerged as a substantial shareholder of the construction outfit after being allotted 870.01 million new shares under the company’s long-term incentive plan on April 1. This brings his total direct shareholding to 890.01 million shares, equivalent to a 21.749% stake.

Loh had previously ceased to be a substantial shareholder of SC Estate Builder on March 24, owing to changes in his shareholdings in Takzim Empayar Sdn Bhd, which held an 11.414% direct stake in SC Estate Builder.

Shares in SC Estate Builder have fallen 50% year to date (YTD) to close at one sen last Monday, valuing the group at RM40.9 million.

Notable movements

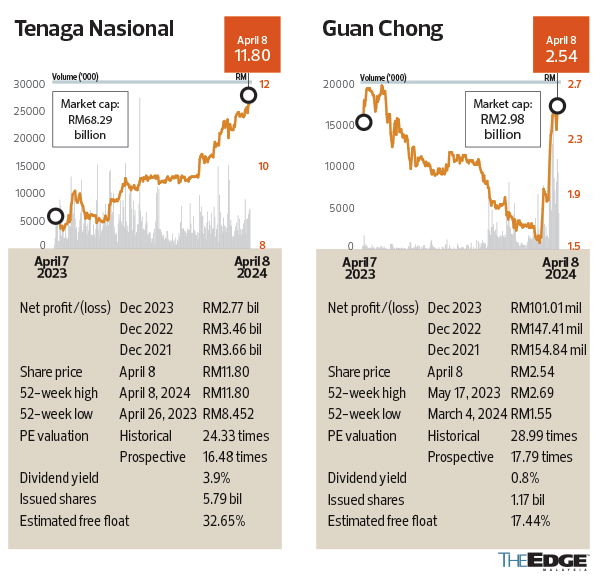

Khazanah Nasional Bhd took profit on its investment in Tenaga Nasional Bhd as the shares rose, disposing of 60 million shares during the week in review. Post-transactions, the sovereign wealth fund has 1.25 billion shares, or a 21.52% direct stake, in the national utility giant.

Shares in Tenaga have risen 17% YTD and 28% over the past one year to close at RM11.80 last Monday, valuing the group at RM68.3 billion.

Filings with Bursa during the week in review also showed the Employees Provident Fund Board (EPF) taking profit on its investment in Guan Chong Bhd, the world’s fourth-largest cocoa grinder, disposing of a total of 7.95 million shares between March 27 and 29. Post-disposals, the retirement fund ceased to be a substantial shareholder of Guan Chong, with 57.94 million shares, or a 4.934% stake.

Shares in Guan Chong have risen 42.9% so far this year, in tandem with the rise in global prices of cocoa beans, which have more than doubled since the beginning of the year. The stock settled at RM2.54 last Monday, giving the company a market capitalisation of RM3 billion.

Guan Chong recently told The Edge that it had put on hold plans to expand its cocoa bean processing plant in Ivory Coast due to a global shortage of cocoa beans, and that it wanted the cocoa bean situation to improve before it undertook the expansion. The group had plans to double its West African capacity to 120,000 tonnes.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments