Cover Story: Consolidation will not ‘take over any land from individual landowners’

This article first appeared in The Edge Malaysia Weekly on April 1, 2024 - April 7, 2024

Appointed the Minister of Plantation and Commodities on Dec 12, 2023, Datuk Seri Johari Abdul Ghani is familiar with the machinery of government, having been the minister of finance II and deputy minister of finance during Datuk Seri Najib Razak’s administration. An accountant by training, the member of parliament for Titiwangsa also has corporate experience and, through his private vehicles, holds stakes in CI Holdings Bhd, KUB Malaysia Bhd, Media Prima Bhd and MyNews Holdings Bhd.

In written responses, Johari answers questions on his plan to consolidate the independent oil palm smallholders (ISHs) in the country.

The Edge: What is the model for the plan to create ISH clusters — via a cooperative or a company (where individual ISHs will become shareholders) or something like the inti/plasma scheme in Indonesia?

Datuk Seri Johari Abdul Ghani: The ministry is currently exploring several models and closely assessing the level of acceptance of the individual landowners towards this idea. The emphasis must be placed on good management and agricultural practices that can be achieved through scaling up operations. Ideally, this model will involve landowners outsourcing the management of the plantation, to a company linked to one (or more) of the big players. The ministry through its agencies will supervise and coordinate these clusters without taking over any land from the individual landowners. The objective of this initiative is to increase the yield of ISHs that ultimately will increase crude palm oil (CPO) production of the country which is currently in a declining trend.

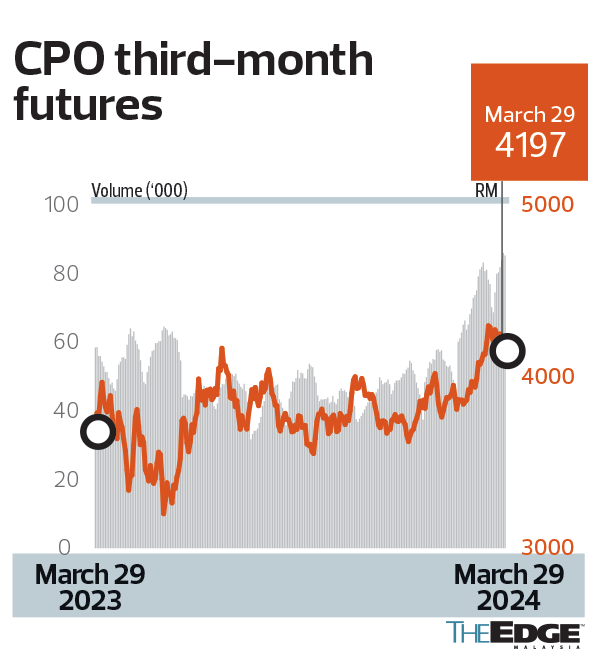

This model will provide consistent supply of labour and quality planting materials (seeds and fertilisers) as well as the high adoption of mechanisation. I believe this project to be an extremely important endeavour, not just for the industry but for our economy as well. Take for instance a 10,000ha cluster. If we are able to increase fresh fruit bunch (FFB) yield by six tonnes per hectare per year, we could generate an additional revenue of RM51 million per cluster (assuming a CPO price of RM4,250 per tonne). Even if we are only successful in consolidating half of the estimated 800,000ha of ISHs, we could generate roughly RM2 billion for our economy purely based on better management practices alone.

Based on an average area of 4ha for each ISH, the creation of 8,000ha to 10,000ha estates would require the participation of 2,000 to 2,500 ISHs. By definition, ISHs are not formally associated with any scheme or plantation company/mill and they act independently, so the first task is to aggregate them into estates. Who will do this? Should it be built on the Sustainable Palm Oil Clusters system under the Malaysian Palm Oil Board (MPOB) or should this be under the mandate of Felcra?

The format for these clusters will be focused on outsourcing the management of the estate. The ministry will lead efforts in undertaking this initiative along with our relevant agencies to engage with all relevant stakeholders to get their buy-in. Recently, I met with representatives from the National Association of Smallholders Malaysia (NASH), who were very receptive to this idea and are looking forward to assisting us in implementing this initiative.

On getting plantation companies to help the ISHs, how have they responded? What is the ministry’s expectation of companies? How will such an arrangement work, without creating a disincentive or pushing costs too high for the corporates, given that they have their own problems with effective management, especially shortage of workers? Will plantation companies be expected to manage the cluster estates?

As consolidation can increase yield and production, industry players have so far been very receptive to this idea and many are keen. Industry players will provide all technical support, knowledge and experience in managing an estate efficiently. The management of these clusters will also oversee replanting activities according to the highest standards and mechanisation, among others. Higher FFB and CPO yields from these consolidated clusters will contribute towards supporting palm oil mills and refineries, which mostly operate below capacity. This will result in a win-win situation for both industry players and smallholders.

If participation in ISH estate is based on land size, how will the differences in the quality of the land (for example, peat land versus mineral soil) and productivity of the oil palm estate be taken into consideration to ensure equitable participation? And the issue of legality has to be addressed, as not all ISHs have evidence of legal ownership, especially with regard to NCR (native customary rights) land.

With regards to the different types of land, we do not intend to take over land ownership, instead we are focused on outsourcing the management of these clusters. A typical cluster of 8,000ha to 10,000ha must be located within the same vicinity to minimise logistical and transport cost as well as to maximise economic gains for participating smallholders and industry players. In addition, prior to the implementation of this initiative, the ministry will carry out a detailed study, not only to identify economically viable land plots, but also include an approach to addressing land issues such as NCR land effectively. The objective of this initiative is to enhance productivity and yield through scalable good agricultural practices in all identified clusters, by leveraging the experience of the large plantation companies.

MPOB has its Tunas programme to help smallholders. Has the programme failed, or has shortcomings, going by the plan for ISH clusters?

Tunas (Tunjuk Ajar dan Nasihat Sawit) was established as an extension service by MPOB mainly to facilitate technology transfer activities related to oil palm, aiming to enhance the management practices of independent smallholders. Tunas has been successful in educating smallholders. This new consolidation initiative would be driven by commercial elements — something that may have been lacking in the past.

Is there a timeline for the cluster programme to be implemented? Will there be a pilot programme tested?

At the moment, we have not set a specific timeline. Our main priority is to get key stakeholders’ buy-in, by engaging both smallholders and industry players. This is vital to explain and educate them on how consolidating small plots into clusters of 8,000ha to 10,000ha and adopting large industry players’ experience in managing plantation plots efficiently could benefit all parties. We expect it to start with a proof of concept, once we get the first 8,000ha to 10,000ha. This is a long-term plan to ensure that the 1.5 million hectares of palm oil planted by smallholders — both independent and organised — can be managed efficiently and produce high yields. My vision is to see the economic viability over the medium and long term. If we can realise this and increase FFB yield by an additional six tonnes per hectare per year, we can produce an additional nine million tonnes of FFB annually, generating additional revenue of RM7.65 billion for the country.

On the World Trade Organization (WTO) panel’s decision, which concluded that the EU’s Delegated Act is discriminatory, you have said that the government will monitor changes to the EU’s regulations to bring them in line with the WTO’s findings and pursue compliance proceedings if necessary. Meanwhile, Malaysia’s claims against EU measures that led it to rule out palm oil-based biofuel as a renewable fuel were rejected. Industry experts have suggested engagement with the EU. Any comments?

We are constantly engaging with the EU and its member states. We welcome any dialogue opportunities with all our trading partners. In our engagements thus far, we continue to underscore the importance of ensuring a level playing field for all edible oils in the world to compete. Malaysia is committed to complying with global sustainability standards. At the forefront of these efforts would be to continue enhancing the Malaysian Sustainable Palm Oil (MSPO) certification to meet the four main components of the European Union Deforestation Regulation (EUDR), namely, traceability, deforestation-free, legitimacy of land title, as well as sustainable labour practices as prescribed by the International Labour Organization. In the recently concluded WTO panel report on the 20 complaints filed by Malaysia regarding the discrimination of palm-based biofuels, the panel ruled 10 for Malaysia and the remaining 10 for the EU. It clearly found that the EU was at fault for discriminatory policy against palm-based biofuels.

The Financial Times reported a source story on March 8 that the EU intends to delay strict policing of imports, including palm oil, from areas prone to deforestation as proposed under the EUDR. This is to give time to countries to comply and should be good for Malaysia as a producing country. Has the ministry been able to confirm this and your comments on this development, if any?

The EU has not officially confirmed the reported delay of the EUDR. Regardless, Malaysia will continue to embark on producing sustainable palm oil for the world. While an implementation delay would be appreciated, especially to provide ample time for smallholders to meet the new requirements, we will continue to enhance the mandatory MSPO scheme into a comprehensive set of standards that will cover the entire supply chain. The recognition of MSPO is a key element in conveying Malaysia’s sustainability journey and will underpin the Malaysian palm oil brand that is of high quality and produced sustainably. Malaysia is committed to addressing critical sustainability issues, including deforestation, biodiversity conservation, climate change, labour practices and land rights. These efforts should form the basis for constructive dialogue between the EU and Malaysia.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments