Brokers Digest: Local Equities - MISC Bhd, Nestlé (M) Bhd, Unisem (M) Bhd, Solarvest Holdings Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on March 4, 2024 - March 10, 2024

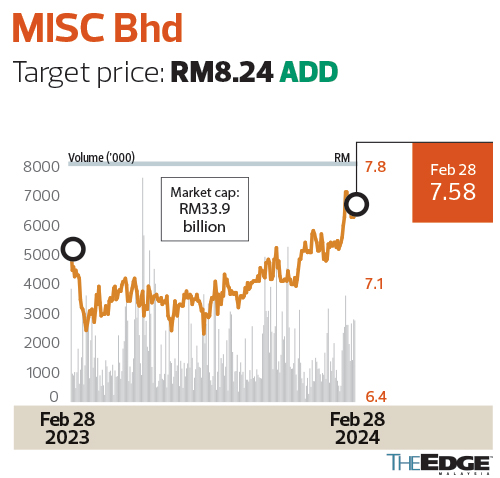

MISC Bhd

Target price: RM8.24 ADD

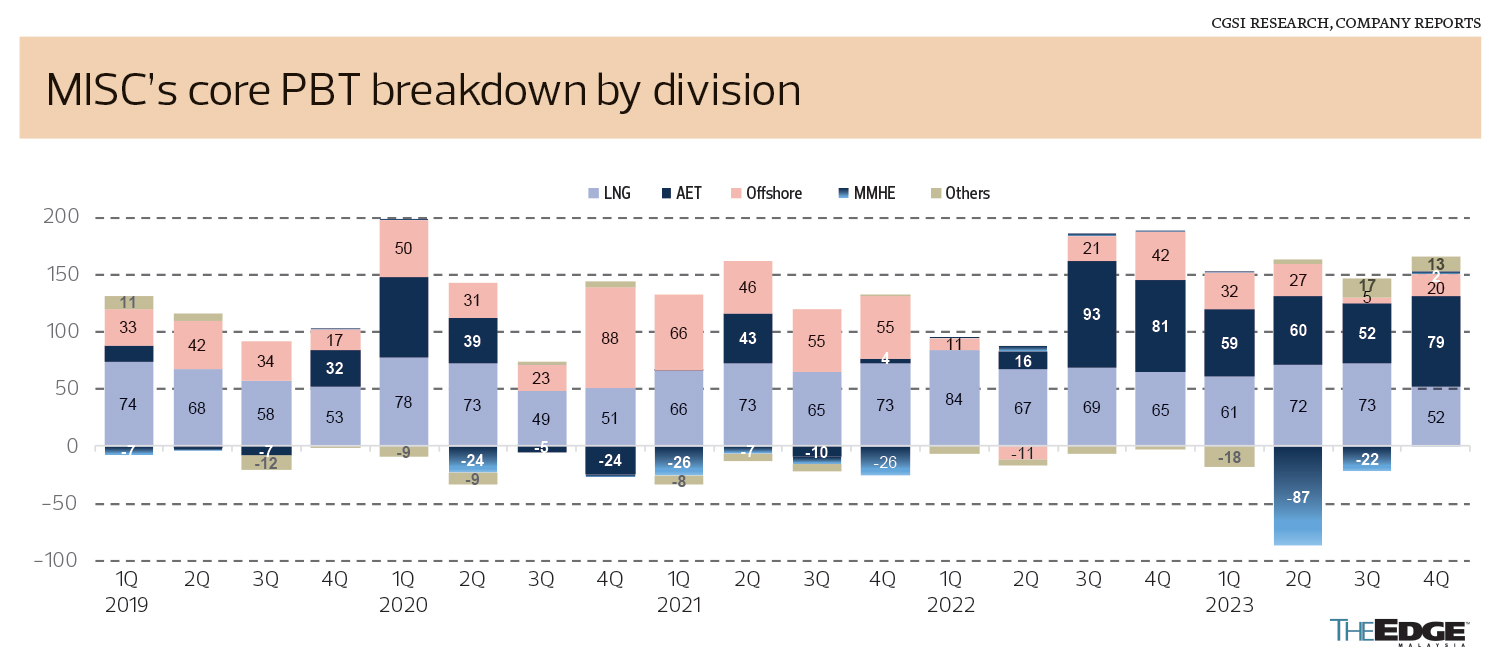

CGS INTERNATIONAL RESEARCH (FEB 27): MISC’s 4Q23 core net profit of US$158 million was 35% higher q-o-q because subsidiary AET delivered a higher profit on the back of a sequential increase in average tanker freight rates, which was driven up by rising Chinese crude oil imports, greater volume of long-haul shipments from the Americas to Asia due to production cutbacks by Middle East producers, and the Red Sea shipping disruptions, which caused about half of tankers that would otherwise have used the Suez Canal to divert via the Cape of Good Hope (adding tonne miles in the process). Aframax crude tanker freight rates also benefited from the migration of coated aframax tankers back to the product trades to benefit from very strong product tanker freight rates.

MISC’s offshore profit in 4Q23 also rose q-o-q as the floating production storage and offloading vessel Mero-3 saw a surge in revenue recognition in the run-up to shipyard completion. Heavy engineering subsidiary Malaysia Marine and Heavy Engineering (MMHE) saw its 3Q23 loss (due to provisions for foreseeable contract losses in its ongoing projects) turn around to a small profit in 4Q23. The above trends were partially offset by a q-o-q decline in LNG earnings as two vessels encountered mechanical difficulties, causing them to go off-hire and incur additional maintenance costs.

MISC’s FY23F core net profit was slightly lower y-o-y as LNG earnings declined from the expiries of several legacy contracts, coupled with losses at MMHE due to loss provisions, partly offset by higher AET profit from stronger crude tanker freight rates. MISC declared a full year DPS of 36 sen (final DPS of 12 sen), in line with expectations.

Upgrade our call to “add” from “hold”, with the key rerating catalysts being likely stronger petroleum tanker freight rates for 1Q24F, as well as the rest of the year, due to demand growth for oil amid very marginal tanker fleet growth. If MISC successfully commissions the FPSO Mero-3 and achieves first oil and final acceptance by end-FY23F, the market may also celebrate this major achievement. We have pencilled in Jan 1, 2025, as the start of the 22½-year firm charter period. MISC is also bidding for more contracts across the gas tanker, petroleum tanker and offshore segments. A potential major win could catalyse its share price.

We raise our SOP-based target price to RM8.24. Downside risks are likely to be closely related to whether MISC encounters technical challenges and/or delays in achieving the final acceptance for the FPSO Mero-3 project. MMHE is continuing to execute three legacy upstream engineering projects, and additional provisions for foreseeable contract losses may yet be booked into FY24F. Aggressive Opec+ supply curbs in the future could also dampen petroleum tanker demand and cause freight rates to weaken.

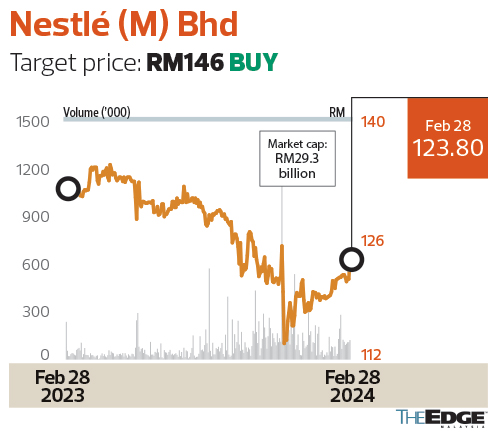

Nestlé (M) Bhd

Target price: RM146 BUY

UOB KAY HIAN RESEARCH (FEB 28): Nestlé Malaysia’s 4Q23 core net profit of RM148 million brought 2023 core net profit to RM659.9 million (+6.4% y-o-y), accounting for 97% of our and 94% of consensus’ full-year forecasts. Despite muted sales growth and an impairment, improved gross margins and a lower tax expense lifted 4Q23 earnings y-o-y. A DPS of 128 sen was declared, bringing the cumulative 2023 DPS to 268 sen (2022: 266 sen).

Operating expenditure, which included an impairment of RM42.6 million, more than offset gross margin gains as 4Q23 operating margins declined by 0.5 percentage point to 11.5% y-o-y. On the back of an effective tax rate of 16.2%, core net profit grew 11.5% y-o-y and 10.8% q-o-q.

No changes to our earnings forecasts. Upside risks include lower-than-expected operating costs, stronger-than-expected recovery in sales and favourable commodity prices. Downside risks are spiralling commodity prices and a weakening of the ringgit against the US dollar. We estimate that for every +10% gain of the US dollar against the ringgit, Nestlé’s earnings are impacted -2.5%. We maintain our “buy” call with an unchanged DCF-based target price of RM146 per share. Nestlé’s safe-haven defensive qualities are backed by its resilient earnings. It offers a decent three-year earnings CAGR (2023-2026) of 9.3% and dividend yields of 2.4% to 2.6% over 2024-2026.

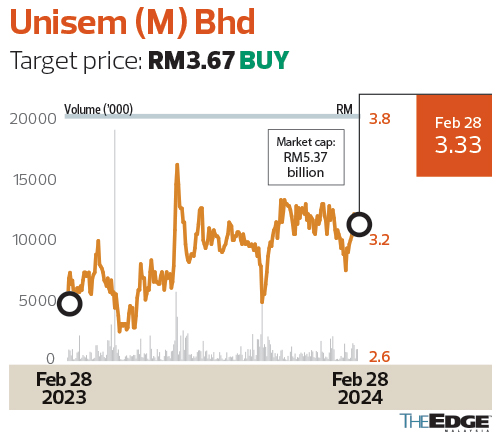

Unisem (M) Bhd

Target price: RM3.67 BUY

RHB RESEARCH (FEB 28): Unisem’s FY23 core earnings met expectations with a 67.5% y-o-y decline to RM80.5 million amid the semiconductor industry’s downturn. Management is cautiously optimistic about FY24 growth, backed by new programmes, customer supply chain diversification and higher loadings, while citing uneven recovery from various customers. We believe the worst is over, and see a positive earnings trajectory ahead from an overall sector recovery and expansion-led growth — although a meaningful uptick may only be seen in 2H24.

Its new Chengdu Phase 3 and Gopeng plants are on track to capture the next semiconductor up cycle. Equipment is expected to come in batches from now, in accordance with the loadings, as management is treading cautiously with the additional capital expenditure on machinery — to manage risks — in its bid to fill up the new massive space (two times) available.

We raise our FY24F earnings forecast by 6.4% on better margin assumption and raise our target PER to 30 times from 27 times previously, resulting in our higher target price of RM3.67 (includes a 2% ESG premium). Note that we revised Unisem’s ESG score to 3.1 from 2.9, mainly under the governance pillar, on meeting the minimum requirement for board diversity and improved guidance and disclosures.

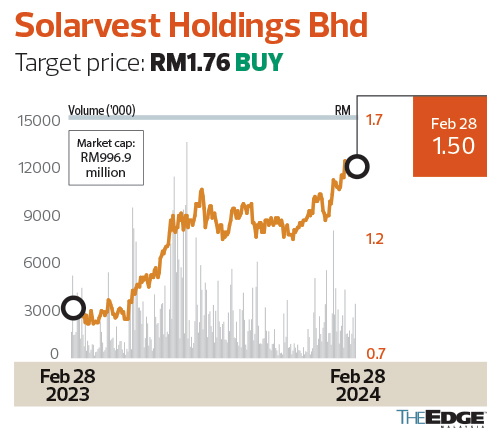

Solarvest Holdings Bhd

Target price: RM1.76 BUY

MAYBANK INVESTMENT BANK GROUP RESEARCH (FEB 28): Solarvest’s 3QFY24 results were better than expected, mainly due to operational savings from completed Large Scale Solar 4 projects. This lifted 9MFY24 core net profit to RM24.5 million (+69% y-o-y), at 86%/83% of our/consensus FY24E. We roll forward our valuation to CY25E. Our new SOP-based target price is RM1.76 (+36sen).

We adjust upwards our core net profit for FY24E by +19% after adjusting for lower operational costs. We currently assume an order book replenishment of RM600 million each in FY25/26E (unchanged). The unbilled order book currently stands at RM242 million.

We understand that management is currently pursuing potential engineering, procurement, construction and commissioning projects totalling 443.4mwp under the Corporate Green Power Programme (CGPP) for order book replenishment in 4QFY24. Meanwhile, Solarvest has secured potential local corporate power purchase agreements of around 110mwp under Powervest and overseas projects of 23.5mwp. We expect the company to continue growing its order book, capitalising on the industry’s 800mw CGPP projects, as well as new renewable energy quotas of 2gw under LSS5 and 400mw quota under the Net Energy Metering scheme.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments