Propel Global eyes growth after exiting PN17

This article first appeared in The Edge Malaysia Weekly on February 19, 2024 - February 25, 2024

PROPEL Global Bhd, formerly known as Daya Materials Bhd, has come a long way from being a financially distressed oil and gas (O&G) firm to becoming an integrated technical solutions provider that offers essential services for industrial clients.

Since Propel Global took over the listing status of Daya Materials in April 2022, the company’s primary focus in the financial year ended June 30, 2023 (FY2023) was to complete the regularisation plan and to exit the Practice Note 17 (PN17) status.

Both targets were accomplished in FY2023.

Propel Global’s regularisation plan — approved by Bursa Securities in October 2021 — was completed in October 2022, and its PN17 status was uplifted in May 2023.

Propel Global executive director and group CEO Angeline Lee Sze Yeen highlights that after several corporate restructuring exercises over the past few years, the company has turned around and it now has a new lease of life.

“If you look at Propel Global today, and if you compare the company to Daya Materials a few years ago, you would notice that we are on the right track financially. The restructuring has been completed, we have some new shareholders and our intention now is to grow,” she tells The Edge in an interview.

Going forward, says Lee, Propel Global will focus on two main business segments — O&G and technical services.

For the O&G segment, the group aims to expand its pipe recovery and well intervention businesses. It is also exploring opportunities in the wireline business that can boost competitiveness in the plug and abandonment segment, as well as the decommissioning programmes for both downstream and upstream facilities in the O&G industry.

As for the technical services segment, Propel Global intends to capitalise on opportunities from foreign multinationals investing in industrial and commercial facilities with the reopening of the economy.

Lee says the idea is to derive synergies between the group’s construction and project management services, as well as heating, ventilation and air conditioning (HVAC) operation and maintenance services. “We will be focusing on these two things (O&G and technical services) that we are good at. But if there are other new opportunities that arise along the way that could add value to us, we might consider them.”

Lee, who was appointed as an executive director in August 2020 and group CEO in April 2022, believes actions speak louder than words and acknowledges that Propel Global will not be able to “perform miracles” in a short period of time because it takes time for a company to recover and grow. “To be honest, we have been facing some challenges when we talked to some investors because most of them still have a negative perception towards [cash-strapped] Daya Materials, so it’s hard for Propel Global to gain recognition.”

Lee, 46, started her legal career in 2001 as a pupil at a law firm, quickly rising through the ranks to become a partner in 2008. After leaving in 2012, Lee co-founded another firm where she became the senior partner, overseeing all aspects of the corporate and finance department. In 2017, she left the legal firm and joined 2 Fish (SG) Pte Ltd as chief operating officer (COO). About a year later, she left the Singaporean O&G company and joined Daya Materials as group COO. Subsequently, Lee was appointed group CEO of Propel Global. Today, she owns a 4.15% stake in the company.

As at Sept 29 last year, Propel Global has four substantial shareholders — Perfect Global Sdn Bhd (18.15%), Siem Offshore Rederi AS (11.89%), WK Propel Sdn Bhd (8.47%) and Export-Import Bank of Malaysia Bhd (7.17%).

Perfect Global is an investment vehicle co-owned by Datuk Low Keng Siong, Lai Ming Chun, Chai Jia Jun and Kong Teck Fong, while WK Propel is controlled by Kong.

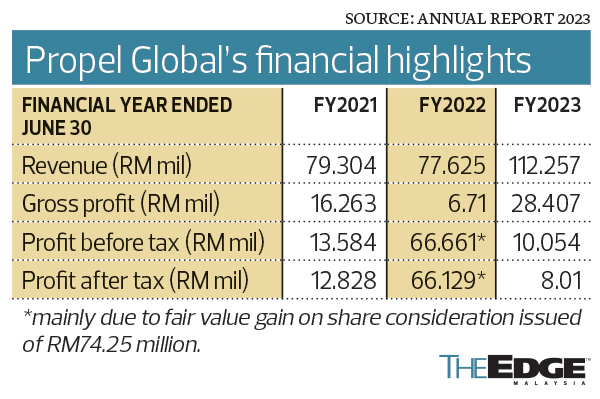

Propel Global reported a profit before tax of RM10.05 million for FY2023, a year-on-year decline of 85%, compared with RM66.66 million in FY2022, mainly due to the absence of fair value gain on share consideration of RM74.25 million (see table).

Its regularisation plan included a restructuring of Propel Global’s operations, a settlement of liabilities to creditors, settlement of professional fees and a private placement. Subsequently, the company’s PN17 status was uplifted after it showed two quarters of net profit.

O&G and technical services

Propel Global currently provides a comprehensive range of services to the upstream and downstream sectors of the O&G industry. These services encompass design, engineering, procurement, construction and commissioning; project management; and maintenance services.

The group also offers building construction and related services for various types of facilities. In addition, it provides operation and maintenance services for HVAC systems while delivering technical solutions for building projects.

Lee says Propel Global’s business focus is to become an integrated provider of technical solutions, emphasising sustainability, digital technology and market agility. “We aim to leverage our core services in O&G and build the technical sector while fostering integration and synergy among our business units. We are also planning to transition to a zero-carbon business focus, including exploring opportunities in renewable energy and electrification. This transformation aligns with industry trends and the evolving landscape of technical solutions and services.”

Lee adds that as Propel Global is eager to grow and expand, the group is open to all possibilities that align with its strategy and vision. “We are dedicated to our core business as an O&G and construction services provider, with a strong focus on our engineering and technical expertise. With this core focus, we can strategically broaden our services to reach a wider customer base spanning healthcare, semiconductors, industrial plants and more.”

It is worth noting that last year, Propel Global acquired E-Maintenance Sdn Bhd, a total computer hardware solutions and service provider, for RM20 million cash. Lee says E-Maintenance’s technical capabilities could complement the group’s services in HVAC and facility management.

“We believe this enables Propel Global to expand our service offerings, bid effectively for contracts and cross-sell to E-Maintenance’s diverse clientele, fostering revenue growth and competitiveness.”

Moreover, the acquisition of 51% equity interest in Best Wide Engineering (M) Sdn Bhd for RM7.82 million in January 2023 has also further strengthened Propel Global’s position in providing design and engineering services.

Best Wide Engineering is a provider of engineering and technical works for the O&G industry.

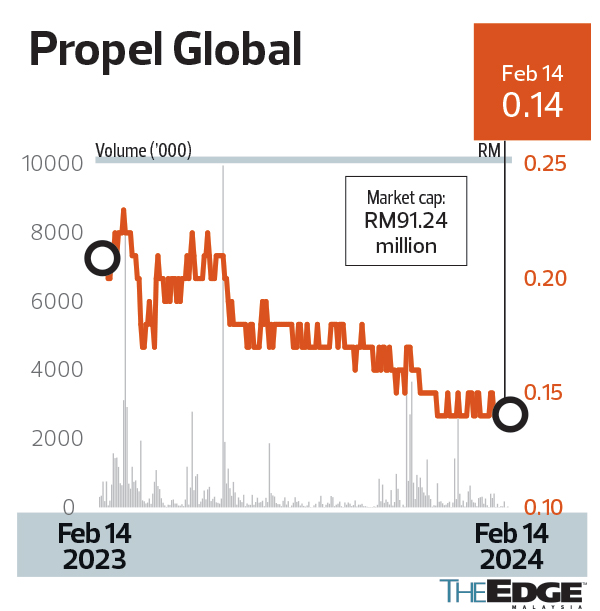

Over the past 12 months, Propel Global’s stock price had declined 36% to close at 14 sen apiece last Thursday, giving the company a market capitalisation of RM91.24 million.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| PGB | 0.125 |

Comments