Investors see sweet value in confectionery stocks

This article first appeared in The Edge Malaysia Weekly on January 29, 2024 - February 4, 2024

CONFECTIONERY stocks on Bursa Malaysia have caught the interest of investors lately, judging by the improved value of the shares compared to a year ago.

Some industry observers say the interest in the confectionery stocks is probably due to improved earnings over the last few quarters as the stabilisation in raw material prices relieved the pressure that has been suppressing margins.

Rakuten Trade Sdn Bhd head of equity sales Vincent Lau says: “Investors are seeing value in mass market brands like these confectionery stocks. They tend to be more resilient in nature and the expectation is that they will be least affected by any economic slowdown. They are seen as ‘recession-proof’ stocks.”

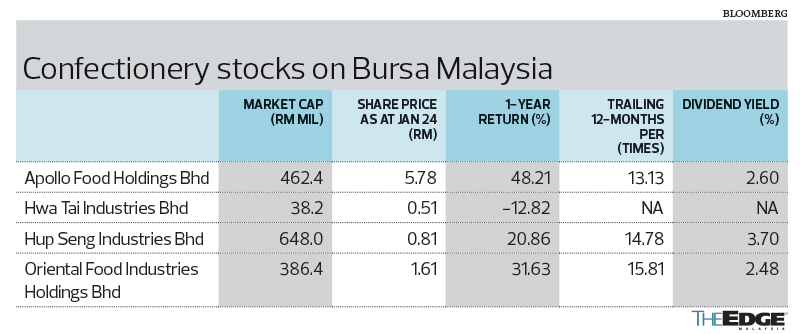

On Bursa Malaysia, confectionery stocks include biscuit manufacturer Hup Seng Industries Bhd and Hwa Tai Industries Bhd and snack food producer Oriental Food Industries Holdings Bhd.

There is also snack food maker Apollo Food Holdings Bhd, which recently announced that its controlling shareholder Keynote Capital Sdn Bhd received a buyout offer from Scoop Capital Sdn Bhd, the franchisee of Baskin-Robbins in Malaysia and Singapore, for its entire 51.31% stake in the confectionery company, amounting to RM238.08 million in cash.

Among the confectionery stocks, Hup Seng, Oriental and Apollo have registered improved financials in recent quarters but Hwa Tai, the odd one out, is still in a net loss position.

Oriental has started to see improvements in revenue and earnings since its first quarter ended June 30, 2022 (1QFY2023); revenue amounted to RM88.96 million, up 47.7% year on year, and net profit stood at RM4.47 million, up more than 300% y-o-y.

In the most recent quarterly earnings — 2QFY2024 — Oriental’s revenue totalled RM110.57 million, up 22.5% y-o-y, and net profit rose 52.5% y-o-y to RM10.86 million.

As earnings improved, the group’s gross margin has also recovered in the latest quarter to 22.24%, versus 11.9% in 1QFY2023.

While some of the improvements can be attributed to the foreign exchange, Oriental CEO Datuk Son Tong Leong says sales volumes have grown in all its export markets, the segment that contributes about 60% of the group’s revenue.

Lower commodity prices in recent times have also helped lift earnings as margins improve.

“Business is looking good. We did face margin pressure in the past because of high commodity prices, which affected raw material prices, plastic packaging and plastic cartons. Commodity prices are now coming off the peak and are stable now, which is good for us. Our margins should improve further,” Son says.

On an annualised basis, Oriental’s net profit for FY2024 could come up to RM33.83 million against revenue of RM412 million, which would be higher than FY2023’s net profit of RM19.13 million on revenue of RM360.01 million.

In regards to the group’s improved share price, which is up 31.63% y-o-y, Son believes investors have taken notice of Oriental’s improved performance.

In addition, he is unfazed by the uncertain economic outlook because of the affordability of the food products that Oriental sells, which is generally quite inelastic to downturns.

Meanwhile, Hup Seng has also recorded better net profit and revenue since its fourth quarter ended Dec 31, 2022 (4QFY2023). Net profit in the quarter amounted to RM12.44 million on revenue of RM94.19 million compared to a year ago, when net profit was RM9.71 million and revenue, RM81.81 million.

In the first three quarters of FY2023, the group recorded y-o-y increases in both revenue and net profit.

For the cumulative nine months ended Sept 30, 2023, Hup Seng’s revenue amounted to RM262.12 million, up 17.4% from a year ago, while net profit totalled RM31.41 million, up more than 100% from a year ago.

Similarly, its gross margin has also improved to 30% for 9MFY2023 compared with 22.5% in the same period last year. If annualised, Hup Seng’s revenue would total RM349.5 million for FY2023 while net profit would amount to RM41.87 million.

Likewise, Apollo’s earnings and revenue had started to improve since 1QFY2023 ended July 31, 2022. Nevertheless, in 2QFY2024 ended Oct 31, 2023, revenue fell 6.1% y-o-y to RM65.98 million and net profit improved slightly to RM9.95 million, from RM9.46 million previously.

Stable business and cash-rich

While earnings of confectionery companies have improved, it has been suggested that Scoop’s recent takeover offer of Apollo could have added to the interest in confectionery stocks.

Having said that, while the announcement of the takeover was made only at end-December, speculation about a takeover had been circulating in the market for some time.

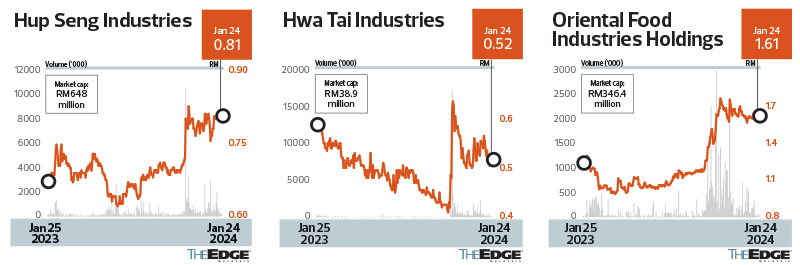

Oriental, Hup Seng and even loss-making Hwa Tai saw a spike in share prices last November. Between Nov 2 and 10, 2023, Hwa Tai’s share price surged 50% to hit 63.5 sen, from 41 sen previously. Some of the gains have been given back over the past months, and at last Wednesday’s close of 52 sen, the company was valued at RM38.91 million.

Similarly, Hup Seng and Oriental saw a noticeable climb in their share price last November.

Hup Seng’s share price gained 20% between Oct 30 and Nov 16, 2023, climbing from 69 sen to 82.5 sen. Its share price has remained steady, trading between 75 sen and 81 sen. At last Wednesday’s close of 81 sen, it was trading at a price-earnings ratio (PER) of 14.78 times and valued at RM648 million.

On the other hand, Oriental’s share price started trending up in early October, rising from RM1.19 on Oct 12 to hit RM1.78 on Nov 14. The counter continued to hover between RM1.59 and RM1.77 after hitting RM1.78 and closed at RM1.61 last Wednesday, which translates into a market capitalisation of RM346.4 million and a PER of 15.81 times.

The RM5.80 per share offer price by Scoop Capital for Apollo shares values the latter at a price-earnings ratio (PER) of 13.18 times, based on its trailing earnings per share of 44.02 sen — the lowest among the three confectionery stocks.

The takeover offer at Apollo has some wondering whether more of such deals could take place in the industry.

People familiar with the industry say there has been talk that Hup Seng’s controlling shareholders are considering cashing out as well. Its 51% shareholder is HSB Group Sdn Bhd, which is controlled by the Kerk family.

Industry observers contend that confectionery companies can be good investments, as they provide a steady stream of revenue and are usually cash-rich.

A source familiar with the industry says: “Confectionery companies in Malaysia are largely medium-sized. It is very difficult to break through to become a big company with a sizeable revenue. Apollo has waited a long time to cash out, but these companies usually have good cash flow. So, they can be a very safe investment that offers a steady cash flow.”

Hup Seng and Apollo have no borrowings. As at Sept 30, 2023, Hup Seng’s cash pile amounted to RM80.22 million; and Apollo had RM134.54 million as at Oct 31, 2023. Oriental held RM54.98 million in cash as at Sept 30, 2023.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments