Rahim & Co regional manager (Sabah) Max Sylver Sintia in presenting The Edge Malaysia | Kota Kinabalu Housing Property Monitor 3Q2023: Better y-o-y performance

This article first appeared in City & Country, The Edge Malaysia Weekly on January 22, 2024 - January 28, 2024

The Sabah housing market improved in 3Q2023, with higher volume and value of transactions compared to a year ago, says Rahim & Co regional manager (Sabah) Max Sylver Sintia in presenting The Edge Malaysia | Kota Kinabalu Housing Property Monitor 3Q2023. “The state registered 1,723 residential transactions worth RM773.36 million in 3Q2023, with year-on-year (y-o-y) growths of 8.09% and 21.17% respectively.

“Properties priced at below RM300,000 per unit dominated the property market with 838 transactions during the quarter under review — accounting for 48.64% of the total volume of transactions — and are worth RM151.47 million or equivalent to 19.59% of the total value of transaction of residential properties in Sabah.”

Then came residential property of between RM300,001 and RM500,000, with 471 transactions (27.34%) worth RM183.6 million (23.74%); followed by those in the RM500,001 to RM1 million bracket, with 332 transactions (19.27%) worth RM226.87 million (29.34%); and lastly, those above RM1 million, with 82 transactions (4.76%) worth RM211.42 million (27.34%).

Properties that were most transacted during the quarter under review were 1-, 2- and 3-storey terraced houses, with 691 transactions worth RM271.85 million. These were followed by condominiums and apartments, with 387 transactions worth RM129.48 million; 1-, 2- and 3-storey semi-detached houses, with 208 transactions worth RM128.45 million; and detached residential homes, with 127 transactions worth RM96.07 million.

“The Kota Kinabalu, Penampang and Putatan conurbation saw the bulk of residential property transactions, with 922 transactions — accounting for 53.51% of the total number of residential property transactions in Sabah — worth RM546.26 million, or 70.63% out of the total value of residential property transactions,” says Max.

“Compared to 3Q2022, the number and value of residential property transactions in Kota Kinabalu, Penampang and Putatan increased by 17.3% and 36.99% respectively.”

In the conurbation, the most-transacted properties were 1-, 2- and 3-storey terraced houses, with 361 transactions worth RM165.89 million. They were followed by condominiums and apartments, with 310 transactions worth RM115.57 million; 1-, 2- and 3-storey semi-detached houses, with 100 transactions worth RM79.49 million; and detached houses, with 49 transactions worth RM115.57 million.

“Notable property transactions recorded in 3Q2023 include the purchase of a parcel of land measuring approximately 26.29 acres in Jalan Sulaman by KTI Development Sdn Bhd for about RM74 million. Tong Enterprise Sdn Bhd purchased a parcel of land measuring about 2.9 acres situated along Jalan Tuaran for RM10 million,” he says.

“Encorp Development Sdn Bhd made its foray into Sabah with the launch of Cahaya Kristal in July 2023. Located in Bukit Kepayan, Kota Kinabalu, Cahaya Kristal has a GDV (gross development value) of RM79.2 million and the development spreads across 1.6 acres of leasehold land. It has a total of 166 units with built-ups of 530 sq ft (1+1 bedrooms, one bathroom, one parking bay) and 790 sq ft (2+1 bedrooms, two bathrooms, two parking bays) in a 10-storey block. The starting price is RM440,000. The project is targeted to be completed by July 2026.”

Two-storey terraced houses

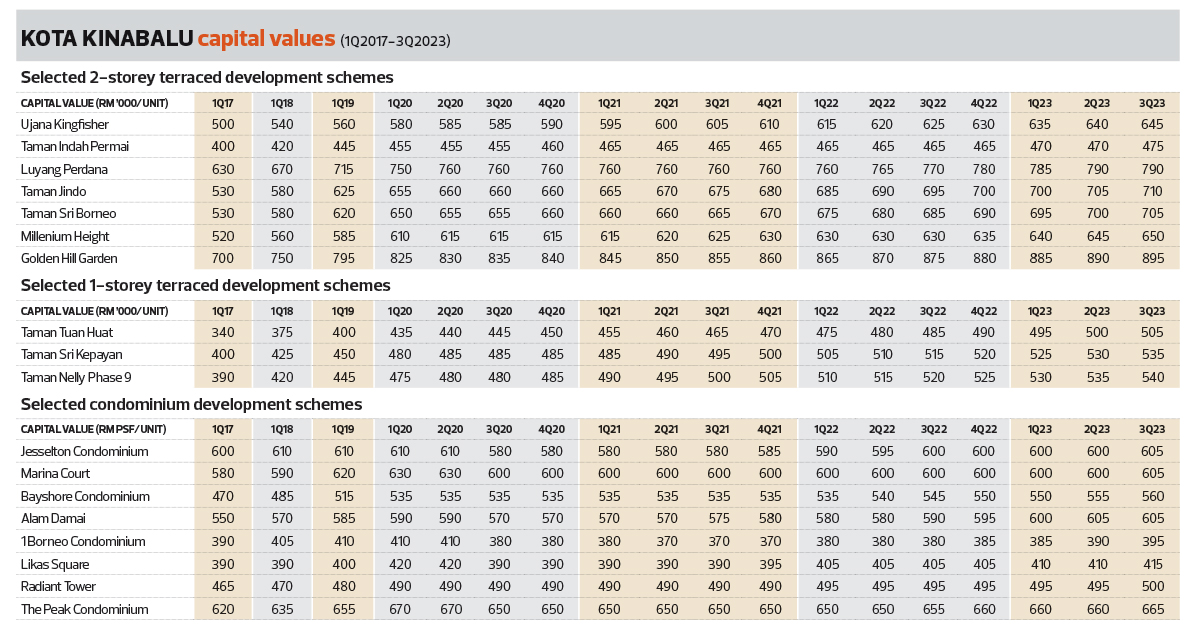

“The 2-storey terraced houses in the monitor recorded an average price growth of 2.64% y-o-y in 3Q2023 compared with the same period in 3Q2022, an increase of 0.68 percentage point,” says Max.

The highest y-o-y price growth was recorded in Ujana Kingfisher, with an increase of 3.2% to RM645,000. This was followed by Millenium Height (3.17% to RM650,000), Taman Sri Borneo (2.92% to RM705,000), Luyang Perdana (2.6% to RM790,000), Golden Hill Garden (2.29% to RM895,000), Taman Jindo (2.16% to RM710,000) and Taman Indah Permai (2.15% to RM475,000).

Quarter on quarter (q-o-q), price growth was seen in Taman Indah Permai (1.06%), Ujana Kingfisher (0.78%), Millenium Height (0.78%), Taman Sri Borneo (0.71%), Taman Jindo (0.71%) and Golden Hill Garden (0.56%). Prices remained unchanged in Luyang Perdana.

The average y-o-y rental growth for 2-storey terraced house sampled was 4.34%. Rental rates in Ujana Kingfisher improved by 8.33% y-o-y to RM1,950 per month. This was followed by Taman Sri Borneo (5.13% to RM2,050 per month), Millenium Height (5% to RM2,100 per month), Luyang Perdana (4.35% to RM2,400 per month), Taman Indah Permai (3.33% to RM1,550 per month), Taman Jindo (2.33% to RM2,200 per month) and Golden Hill Garden (1.89% to RM2,700 per month).

Q-o-q, Ujana Kingfisher registered rental growth of 2.63%. This was followed by Taman Sri Borneo with 2.5% growth, Millenium Height (2.44%), Taman Jindo (2.33%), Luyang Perdana (2.13%) and Golden Hill Garden (1.89%). Rental remained unchanged at Taman Indah Permai.

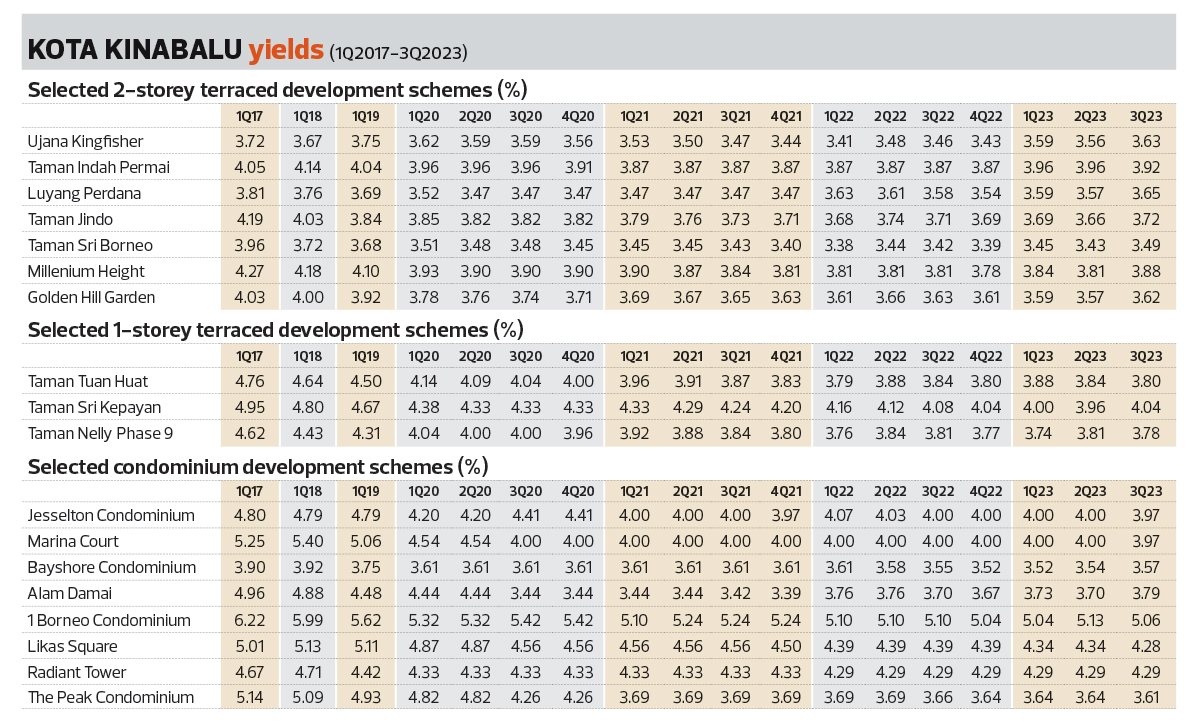

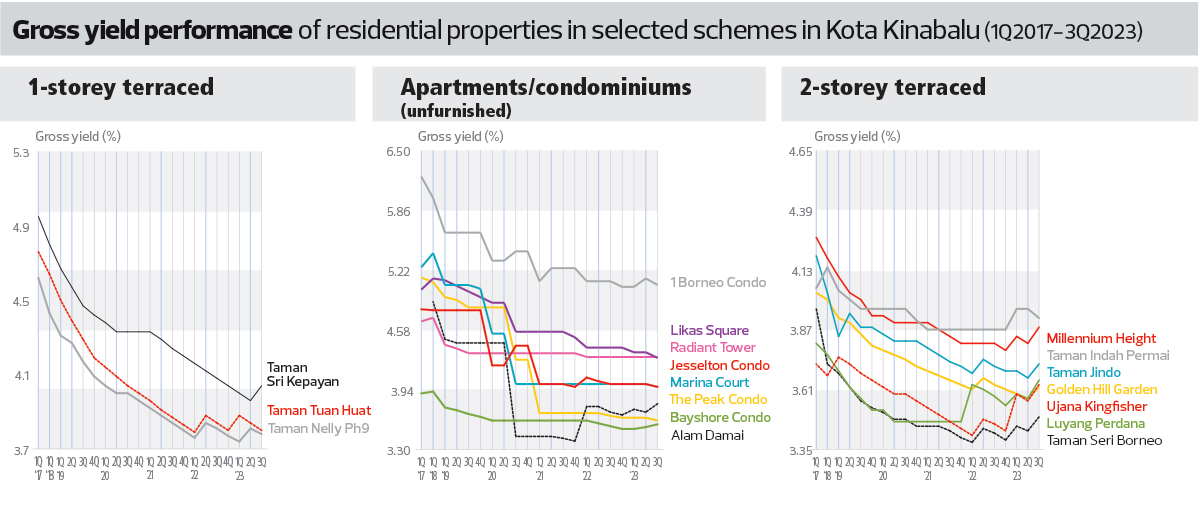

Average gross yield for 2-storey terraced houses was 3.7%, a slight increase of 0.06 percentage point compared with the previous year.

The highest gross yield was registered at Taman Indah Permai (3.92%). This was followed by Millenium Height (3.88%), Taman Jindo (3.72%), Luyang Perdana (3.65%), Ujana Kingfisher (3.63%), Golden Hill Garden (3.62%) and Taman Sri Borneo (3.49%).

One-storey terraced houses

For 1-storey terraced houses, the y-o-y price growth was 3.95%, a 0.04 percentage point decrease from the 4.11% recorded in 3Q2022.

The highest y-o-y price growth was recorded in Taman Tuan Huat, with an increase of 4.12% to RM505,000, followed by Taman Sri Kepayan (3.88% to RM535,000) and Taman Nelly Ph 9 (3.85% to RM540,000).

Q-o-q price growth results show that Taman Tuan Huat registered 1% growth, followed by Taman Sri Kepayan (0.95%) and Taman Nelly Ph 9 (0.94%).

“The average rental growth y-o-y for 1-storey terraced houses was 3.04%. Rental rates in Taman Tuan Huat improved by 3.23% y-o-y to RM1,600 per month. In Taman Nelly Ph 9, rental rates grew by 3.03% to RM1,700 per month, while Taman Sri Kepayan recorded an increase of 2.86% to RM1,800 per month,” says Max.

Q-o-q monthly rental in Taman Nelly Ph 9 improved by 3.03%. No quarterly rental growth was recorded in Taman Tuan Huat and Taman Sri Kepayan.

Average gross yield achieved for 1-storey terraced houses was 3.87%, down by 0.03 percentage point from 3Q2022.

The highest yield was registered at Taman Sri Kepayan at 4.04%, followed by Taman Tuan Huat (3.8%) and Taman Nelly Ph 9 (3.78%).

High-rise units

“The condominiums in the monitor recorded an average 1.99% price growth y-o-y in 3Q2023, which translates to a decrease in percentage point of 0.04 from 3Q2022,” says Max.

He says y-o-y price growth of condominiums in the monitor averaged RM544 psf in 3Q2023.

1 Borneo Condominium registered the highest y-o-y price growth with 3.9% to RM395 psf, followed by Bayshore Condominium (2.8% to RM560 psf), Alam Damai (2.5% to RM605 psf), Likas Square (2.5% to RM415 psf), The Peak Condominium (1.5% to RM665 psf), Radiant Tower (1% to RM500 psf), Jesselton Condo (0.8% to RM605 psf) and Marina Court (0.8% to RM605 psf).

Q-o-q, 1 Borneo Condominium registered a price growth of 1.3%, followed by Likas Square (1.2%), Radiant Tower (1%), Bayshore Condominium (0.9%), Jesselton Condo (0.8%), Marina Court (0.8%) and The Peak Condominium (0.8%). No q-o-q price growth was recorded in Alam Damai.

Meanwhile, rental rates in Alam Damai increased by 5% y-o-y to RM1.91 psf per month. This was followed by Bayshore Condominium (3.45% to RM1.67 psf per month) and 1 Borneo Condominium (3.13% to RM1.67 psf per month). No rental improvement y-o-y was recorded by the rest of the samples.

Q-o-q, Alam Damai registered an improvement of 2.44% followed by Bayshore Condominium with an 1.69% increase. There were no increments recorded for the rest of the areas in the monitor.

Average gross yield for condominiums was 4.07%, a slight decrease of 0.02 percentage point from 3Q2022.

The highest gross yield was recorded at 1 Borneo Condominium with 5.06%, followed by Radiant Tower (4.29%), Likas Square (4.28%), Jesselton Condo and Marina Court (both 3.97%), Alam Damai (3.79%), The Peak Condominium (3.61%) and Bayshore Condominium (3.57%).

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| ENCORP | 0.270 |

Comments