Johan, George Kent hit one-year high as largest shareholder mulls options

KUALA LUMPUR (Jan 30): Two counters linked to Tan Sri Tan Kay Hock, namely Johan Holdings Bhd and George Kent (M) Bhd, saw their respective share prices hit a one-year high during Tuesday’s trading session.

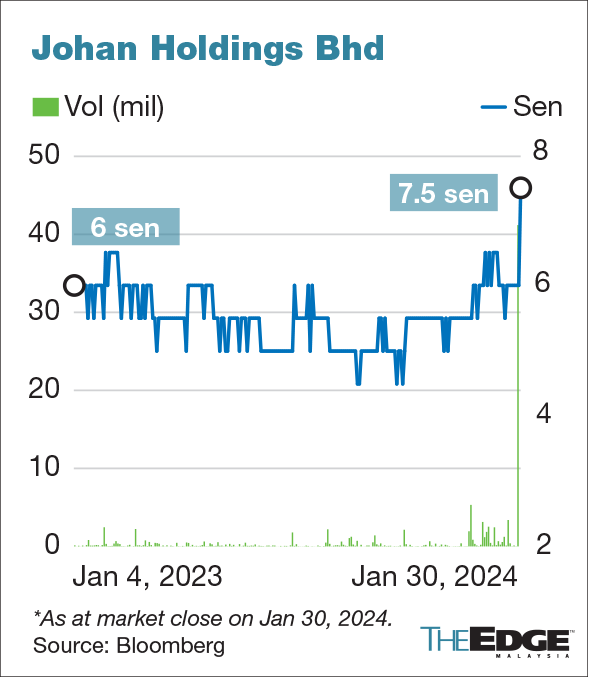

Johan, which was barely traded with a two-month average volume of 467,500, emerged among the most active stocks on Bursa Malaysia after Tuesday’s noon break. It saw a total of 41.2 million shares change hands, its highest since August 2021.

The counter recorded its one-year high at 8.5 sen during Tuesday’s trading session, before closing at 7.5 sen — still up by 1.5 sen or 25% from its previous closing price of six sen. At 8.5 sen, the group is valued at RM87.6 million.

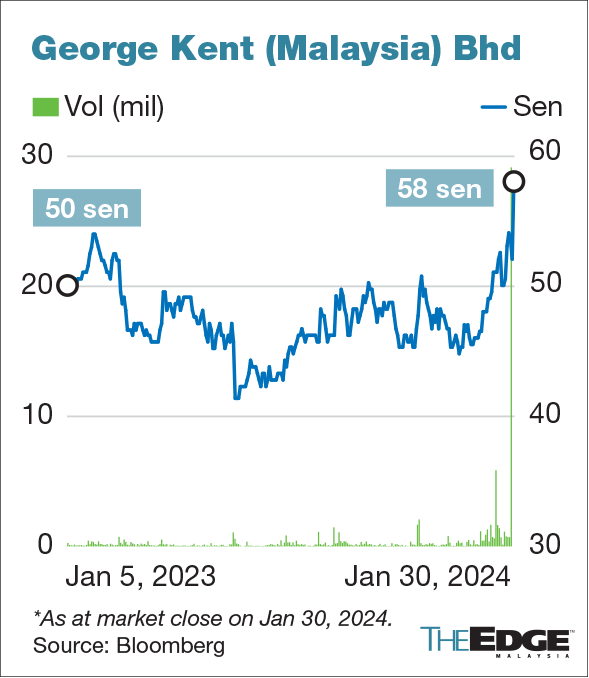

Meanwhile, George Kent saw its share price close at 58 sen, up seven sen or 13.5%, on Tuesday. The counter hit 62 sen, its highest over the last one year. Volume shot to 29.1 million shares — a four-year high — during the day.

At 58 sen per share, George Kent is valued at RM323.67 million.

While there are no announcements made by George Kent that could warrant the spike in its share price, it could be fuelled by rumours that its largest shareholder Tan is looking at options that could address the issue of losses at its associate companies.

Tan holds a 45.56% stake in George Kent through Kwok Heng Holdings Ltd, Kin Fai International Ltd, Suncrown Holdings Ltd and Star Wealth Investment Ltd, as well as Johan Equities Sdn Bhd.

In the financial year ended March 31, 2023 (FY2023), George Kent made a paltry net profit of RM739,000, compared with RM31.3 million in the preceding financial year. The plunge in profitability was due to the RM18.43 million losses at its associates during the year that George Kent recognised, compared with just RM2.2 million in FY2022.

In the six-month period ended Sept 30, 2023 (1HFY2024), George Kent's share of the losses at associates almost doubled to RM6.3 million, compared with RM3.97 million in the corresponding period, dragging the group's net profit to RM4.2 million. In the corresponding period, the group reported RM15.5 million net profit.

Note that George Kent holds a 40% stake in Dynacare Sdn Bhd, a rubber glove manufacturing company. The group had been awarded a contract to design and build a glove manufacturing plant in Lumut Port Industrial Park, Perak in October 2021 for a contract price of RM686.5 million.

However, the contract was revised on March 31, 2023 to limit the scope of works for design, construction, completing, testing and commissioning for up to six double formers lines for a total sum of RM187.3 million in accordance with Dynacare’s decision to have six lines under Phase 1.

Johan holds a 60% stake in Dynacare. Tan is also the largest shareholder of Johan with a 60.67% stake.

Besides manufacturing water meters, George Kent is said to still be eyeing a slice of the country’s rail developments. Recall that George Kent was a partner in the Light Railway Transit 3 (LRT3) project between 2015 and 2021.

A slew of rail infrastructure projects are being planned by the government including the Klang Valley Mass Rapid Transit Line 3, the Penang LRT, the proposed Johor Bahru LRT as well as the Kuala Lumpur-Singapore high speed rail.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments