Pan Malaysia in limelight after stockbroking asset sale

This article first appeared in The Edge Malaysia Weekly on January 22, 2024 - January 28, 2024

THE recent sale of Pan Malaysia Holdings Bhd’s (PMH) stockbroking and asset management subsidiaries has sparked interest in the counter.

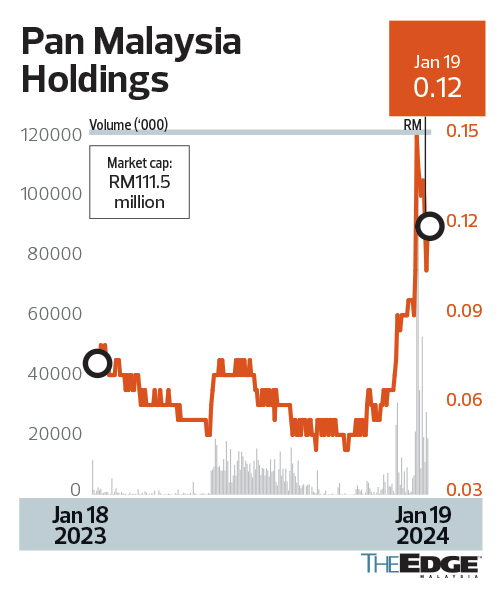

The share price of PMH, which had long fallen off the radar screen of investors, surged 173% to 15 sen on Jan 9 from five sen in mid-November 2023, its highest level since Oct 8, 2020.

With the stockbroking arm no longer PMH’s jewel in the crown, it is unclear what is driving the rally in its share price. The company only has an asset in the hospitality sector now — the Corus Paradise Hotel in Port Dickson, Negeri Sembilan.

Last November, PMH announced that it had completed the disposal of PM Securities Sdn Bhd, PCB Asset Management Sdn Bhd and Miranex Sdn Bhd to NewParadigm Capital Ventures Sdn Bhd for RM90 million.

Market watchers have attributed the spike in PMH’s share price to these disposals as the proceeds were larger than PMH’s market capitalisation at the time.

For several years, PMH had been trading at between five and seven sen, giving it a market value of between RM46.45 million and RM65.03 million. At last Friday’s closing price of 12 sen, PMH had a market capitalisation of RM112 million.

Trading volume has also swelled of late.

Many parties eyeing stake in company

Sources say PMH is currently in talks with several parties, including a private property developer, to sell a block of shares in the company.

“One of the plans is to take up a block in PMH as the property developer is looking to expand its business into hospitality,” a source says.

This was confirmed by PMH’s spokesperson.

“There have been parties that approached us when they learnt that we sold PM Securities,” the spokesperson tells The Edge when contacted.

Malayan United Industries Bhd (MUI), which is controlled by businessman Tan Sri Khoo Kay Peng, is the single largest shareholder of PMH with a 68.32% stake.

MUI is in the hospitality business as well as retail and property. The group owns and operates hotels in Malaysia and the UK under the Corus and Laura Ashley brands, including the Corus Hotel in Jalan Ampang, Kuala Lumpur and Corus Hotel Hyde Park in London.

In the first quarter of its financial year ended Sept 30, 2023, PMH suffered a higher net loss of RM848,000 on lower revenue of RM1.35 million compared with a loss of RM363,000 on sales of RM1.63 million in the previous corresponding period.

The 10-storey Corus Paradise Resort in Port Dickson and the surrounding land that PMH owns have a book value of RM34.83 million, according to its 2023 annual report.

The last time the company attracted investor interest was back in 2014 when its controlling shareholder Khoo, who had been out of the corporate limelight for a long time, planned to restructure and revamp the MUI group of companies. The plan included selling some of the assets to unlock value in the group. Apart from MUI and PMH, the other companies in the MUI stable were MUI Properties Bhd, and Pan Malaysia Corp Bhd, which owned hotels, department stores and a securities firm among others. MUI’s best-known business venture is the Metrojaya chain of department stores.

In late 2014, Khoo planned to sell his stake in PMH to Datuk Dr Yu Kuan Chon, who had initiated a move to take over the loss-making entity at 12 sen a share. It is understood that the acquisition attempt was due to Yu’s interest in the company’s brokerage business.

The proposed deal led to PMH’s shares surging to a high of 52 sen per share at the time, prompting an unusual market activity query from Bursa Malaysia.

However, the proposal lapsed in 2016 after MUI and Yu terminated their agreement on the disposal of MUI’s 69.19% equity interest in PMH to Yu. MUI said the RM77.12 million sale was cancelled due to the non-fulfilment of a condition precedent for the deal by the cut-off date.

The deal was originally expected to be completed within three months of the signing of the share sale agreement on Dec 12, 2014. However, the cut-off date was subsequently extended several times.

In May 2015, the Securities Commission Malaysia, through a letter to PM Securities rejected the latter’s application for a change in its controlling shareholder.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments