Insider Moves: Binasat Communications Bhd, Spritzer Bhd, Minetech Resources Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on January 22, 2024 - January 28, 2024

Notable filings

Notable shareholding changes at Bursa Malaysia-listed companies for the week of Jan 8 to 12 included those at Binasat Communications Bhd, in which Hextar Capital Bhd (formerly Opcom Holdings Bhd) raised its equity interest.

The purchase of 26.2 million shares, or a 6.75% stake, by Opcom VC Sdn Bhd on Jan 12 via a direct business transaction raised Hextar’s deemed interest in Binasat to 24.78% — a move which Binasat says “fortifies [its] position as a key player in providing telecommunications support services for satellite, mobile and fibre optic networks as well as transmission and distribution for network utility infrastructure construction services”.

Hextar group CEO Datuk Eddie Ong Choo Meng — who emerged as a substantial shareholder of Opcom Holdings in February 2021 after buying a 15.28% stake from its co-founder Datuk Seri Mukhriz Mahathir — is deemed interested in the stake.

Stock market data showed 26.23 million shares changing hands at 56 sen apiece or RM14.69 million in total over four direct deals on Jan 12, above the 29 sen to 30.5 sen the shares were being traded at on the open market. The transaction price is the same as what Opcom Holdings (which changed its name to Hextar on Dec 11, 2023) paid when it emerged as Binasat’s single largest shareholder last September after buying an 18.03% stake from Binasat’s managing director Na Boon Aik for RM39.2 million.

Binasat’s unaudited net assets stood at 35 sen per share on Sept 30, 2023. The counter closed at 29.5 sen last Wednesday, valuing the company at RM114.5 million.

Notable movements

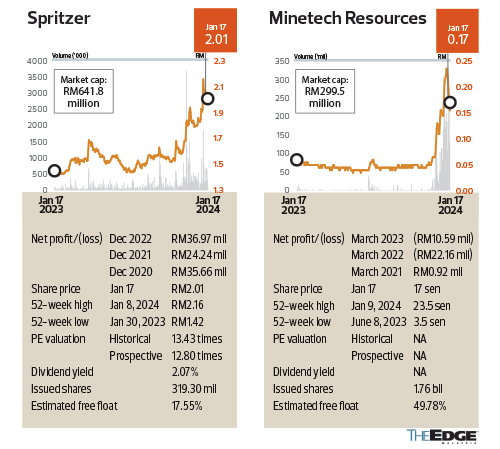

The share price of Spritzer Bhd — which has mineral water plants in Taiping, Perak, and Yong Peng, Johor, and is looking to set up another plant in Bukit Gantang, Perak, to sustain its leadership position in bottled water — is up 9.8% year to date, having closed at RM2.01 on Jan 17. The stock is off its recent high of RM2.16 on Jan 8.

Spritzer, which has targeted to pay out at least 35% of its earnings since June 2022 and paid a dividend per share of 6.25 sen (36% payout) in FY2022 and 4.5 sen (39% payout) in FY2021, will announce its first and final dividend for FY2023 when it releases its full-year results in late February.

The company, which undertook a one-for-two bonus issue in June 2023, saw a 41% year-on-year increase in net profit for the first nine months of FY2023 to RM36.27 million. FY2023 dividend per share could range between five and six sen, implying a 2.5% to 3% yield, assuming a 35% to 40% payout by annualising its nine-month earnings, according to back-of-the-envelope calculations.

Filings show Spritzer non-executive chairman Datuk Lim A Heng @ Lim Kok Cheong — who is executive chairman and major shareholder of Yee Lee Corp Bhd — buying 250,000 Spritzer shares at RM1.90 each via a married deal on Jan 5, raising his direct holding to 18.48 million shares or 5.84% equity interest, while deemed interested in another 45.9% stake.

His younger brother, Spritzer managing director Datuk Lim Kok Boon, bought 500,000 shares on Jan 11 and 20,000 shares on Jan 12, raising his direct holding to 12.64 million shares or 3.96% equity interest, while deemed interested in another 3.01% stake.

On Jan 10, Lim and his sons Spritzer group CEO Kenny Lim Seng Lee and sales and operations director Lim Hock Lai each received 351,750 shares vested under the Employees’ Share Grant Plan, which were paid using treasury shares from share buybacks. Spritzer executive director Lam Sang received 281,250 shares under the share grant plan.

Closing at 17 sen on Jan 17, the share price of civil engineering specialist Minetech Resources Bhd was up 17.2% year to date, having come off its recent peak of 23.5 sen on Jan 9 when sentiment was buoyed by the appointment of its new executive chairman Abang Abdillah Izzarim Abang Abdul Rahman Zohari, the 45-year-old son of Sarawak Premier Tan Sri Abang Abdul Rahman Zohari Abang Openg.

Stock exchange filings show Abang Abdillah buying 12 million Minetech shares on Jan 5 and 20 million shares on Jan 10 via Majestic Salute Sdn Bhd, raising his holding to 272 million shares or 16.828% equity interest. He had acquired 240 million shares, or a 15.58% stake, prior to his appointment.

Abang Abdillah is also an independent non-executive director at Berjaya Land Bhd and was formerly executive chairman of Sarawak Consolidated Industries Bhd for about 5½ months, from June 28 to Dec 11, 2023.

Filings show Minetech chief financial officer Mohd Dzulfadhly Rozelan sold two million shares, or a 0.113% stake, for RM390,000 on Jan 12, which works out to 19.5 sen apiece. The disposal trimmed his holding to 300,000 shares or 0.017% equity interest.

A Jan 8 filing showed that Minetech executive director Matt Chin Leong Choy is no longer a substantial shareholder after selling 37 million shares in a direct business transaction on Jan 5. On Jan 16, his 70-year-old father Choy Sen @ Chin Kim Sang and brother Chin Seong Choy resigned from their positions as executive directors.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| BINACOM | 0.255 |

| BINACOM-WA | 0.090 |

| BJLAND | 0.365 |

| BURSA | 8.170 |

| HEXCAP | 0.375 |

| MINETEC | 0.140 |

| SCIB | 0.280 |

| SPRITZER | 2.450 |

Comments