Limited upside for water stocks ahead of SPAN’s tariff hike decision

This article first appeared in The Edge Malaysia Weekly on January 15, 2024 - January 21, 2024

WITH a water tariff hike set to take place soon, water-related stocks have been on investors’ radar. But given that most have enjoyed a price surge in the past few months and the tariff adjustment catalyst has already been priced in, analysts say the upside for these counters is limited for now.

That said, efforts to reduce non-revenue water bode well for water pipe manufacturers like Engtex Group Bhd, YLI Holdings Bhd and Resintech Bhd.

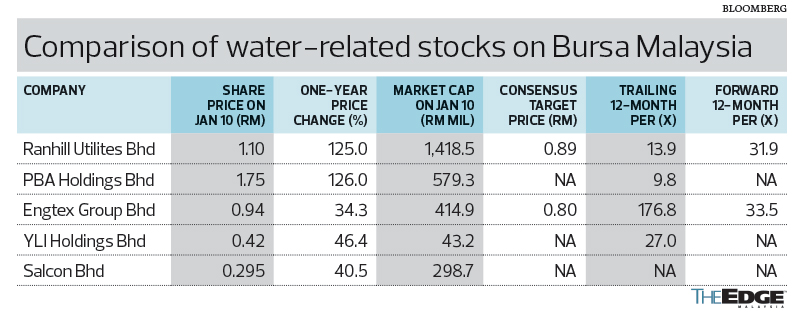

Among the water-related stocks, PBA Holdings Bhd has the lowest price-earnings ratio (PER) of below 10 times, but it is uncertain if the Penang government will allow PBA to further increase its tariffs.

Logically, PBA ought to bump up its tariffs even more for business sustainability, according to one analyst who covers the water industry. He points out that the state’s domestic water tariff is the lowest in Malaysia, with the last review being in April 2015.

Last Tuesday, Bernama reported that the National Water Services Commission (SPAN) is scheduled to hold a press conference within the next two weeks on the issue of tariff hikes.

To be fair, regionally, Malaysia is one of the countries with the lowest average tariff of RM1.22 per cubic metre of water. Incredibly, states like Pahang and Perlis have not revised their water tariffs for 39 and 26 years respectively.

Natural Resources, Environment and Climate Change Minister Nik Nazmi Nik Ahmad has said that by 2040, the government intends to change the perception of the water sector as one that requires government welfare to one that has a value for investment so that water supply operators in the country have the confidence to start making much-needed investments.

However, an immediate issue that needs to be addressed is the reduction of the non-revenue water rate.

According to the analyst, PBA’s valuation is low so it is relatively undervalued. At the same time, the quantum of the water tariff hike could be higher for Penang.

In the past one year, PBA’s share price has doubled from around 80 sen in early November last year to close at RM1.71 last Thursday for a market value of RM566 million. For the first nine months of 2023, PBA posted a net profit of RM46.44 million, a 35.8% decline against RM72.32 million in the previous corresponding period, due to the absence of tax credits. But its pre-tax profit was higher at RM54.34 million against RM39.47 million previously.

Penang State Secretary and Penang Development Corp each hold 55% and 10% of PBA respectively.

In comparison, the analyst highlights that Ranhill Utilities Bhd is trading at a far richer valuation of about 30 times PER. There has been speculation that YTL Power may take Ranhill private, following its move to raise its stake in Ranhill to 21.77% from 18.87% in early November last year when it first surfaced as a substantial shareholder.

“From our engagement with the Ranhill management, they will block any general offer if there is [one] unless the offer price is attractive, which I think is unlikely. Based on YTL Power’s past track record, it will not buy at an extremely exorbitant price,” the analyst observes.

Bloomberg data shows that there is only one “buy” call on Ranhill, two “hold” and one “sell”, with a consensus target price of 89 sen, which suggests a downside potential of 16%, given that Ranhill’s share price has also doubled since end-October last year to RM1.06 as at last Thursday. Its current share price values the company at RM1.37 billion.

In the first nine months of 2023, Ranhill’s net profit grew 40.9% to RM33.4 million from RM23.71 million previously, underpinned by the higher recognition of water revenue, construction progress of Ranhill Solar I as well as net electrical output and capacity factor reported in Ranhill Sabah Energy I Sdn Bhd.

Ranhill is estimated to register a net profit of RM45.1 million and RM47.7 million in FY2023 and FY2024 respectively.

A hike in water tariffs would be a fair and logical move to take — given that the last increase was years ago — as operating costs have increased tremendously even as water demand grows and climate change makes water sustainability more difficult to ensure.

The analyst is of the view that strong political will is needed to hike water tariffs. In 2022, the total cost of domestic water subsidies in Penang amounted to RM103.71 million, according to PBA’s Annual Report 2022.

Another analyst is also of the view that there is not much upside for water-related stocks in the near term.

“In terms of further catalysts, I don’t think there are any, but if the water adjustment is going to happen soon, the demand for water infrastructure and pipemakers will increase to replace the ageing pipes, so it is more on the demand side,” he says.

He adds that efforts to revamp water infrastructure will benefit water players in the long run.

“The government has long sought to upgrade the water infrastructure, but has been unable to do so due to political issues as any revision in the tariffs can impact the lower-income group. Nonetheless, the hike in water tariffs is unavoidable as some states have yet to see an increase for many years.

“The cabinet paper has been submitted to enable all states to increase the water tariffs. The government has a thorough road map to reduce the national non-revenue water rate from 36% in 2021 to 20% by 2030. All this ageing water infrastructure requires a huge investment and, hence, with the increasing tariffs, it could generate more capital expenditure for pipe replacement and non-revenue water programmes.”

Investors expect pipe manufacturers to benefit. Since early October 2023, Engtex Group Bhd’s share price has gained about 50% to close at 93.5 sen last Thursday for a market capitalisation of RM412.7 million.

In a Nov 27 note, CGS-CIMB Research said Engtex, one of the few domestic players capable of producing larger diameter ductile iron and mild steel pipes, will be a key beneficiary if the tariff hike materialises, which would accelerate water infrastructure upgrade projects. Local steel and pipe prices have largely stabilised in the past four months, which may provide room for margin expansion and better earnings visibility.

Engtex’s net earnings tumbled 77.9% to RM8.6 million for the first nine months of 2023 against RM38.82 million in the same period a year ago, owing to higher procurement costs for its raw material and trading inventories and production costs for most of the manufactured steel products.

Analysts tracked by Bloomberg forecast a lower net profit of RM12 million in FY2023 for Engtex before rebounding to RM30.5 million in FY2024. The consensus target price is 80 sen, which implies a downside potential of 14.4%.

Apart from Ranhill, Salcon Bhd, which is involved in the water and wastewater engineering business, also saw the emergence of a substantial shareholder last year — Berjaya Corp Bhd — with a 14.54% stake.

Salcon incurred a slightly higher net loss of RM6.22 million for the first nine months of 2023, compared to RM6.21 million in the same period in 2022, mainly due to lower gross profit margin for the construction division.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments