Market Recap: Bursa Malaysia’s biggest winners and losers in 2023

This article first appeared in Capital, The Edge Malaysia Weekly on December 25, 2023 - December 31, 2023

IT was another challenging year for Bursa Malaysia-listed companies as they resumed their recovery from the lingering effects of the Covid-19 pandemic amid geopolitical conflicts, while also ushering in what is hopefully the end of high inflation and interest rate hikes towards the closing of the year.

Indicators point towards 2023 being a watershed year for Asean equities, and this was reflected in Asian bourses ending the year in a mix of negative and positive territories.

Japan’s Nikkei 225 was up 27.3% year to date (YTD) as at Dec 19, as were South Korea’s Kospi (+14.85%) and Indonesia’s JSX Index (+4.92%). Singapore’s Straits Times Index was down 4.14%, however, along with the Stock Exchange of Thailand (-16.41%) and Hong Kong’s Hang Seng Index (-14.56%).

The FBM KLCI lost a marginal 1.71% YTD to 1,465.67 points on Dec 19.

In a Dec 15 report, RHB Research says the improved performance of some of the stocks on Bursa Malaysia in the second half of 2023 was driven by sectors such as power, construction and properties.

“Besides, certain corporate exercises, value unlocking and thematic play trends were also among the main drivers. Meanwhile, the FBM KLCI’s performance was dragged by the banking sector and weak broad-based sentiment. This was compounded by the weakening of the US dollar. Intermittent buying from local institutions and foreign fund flows continue to undermine our local bourse,” it says.

RHB Research adds that the small and mid-cap stocks are now trading at a discount (-2.2 times) to the FBM KLCI, owing to 2024’s forecast growth prospects of 13.3% compared with 9.3% growth for the FBM KLCI.

“Valuations remain attractive, and we believe there remains bottom-up opportunities in this space for alpha generation, if one looks hard enough,” it says, adding that going into 2024, the expected improvement in macroeconomic growth and a reversal of US dollar strength — from a shift in expectations of the US Federal Reserve’s monetary policy narrative and gradual China recovery — could offer more reasons for foreign investors to relook at Asean equities.

The Edge looks at this year’s top winners and losers according to market capitalisation.

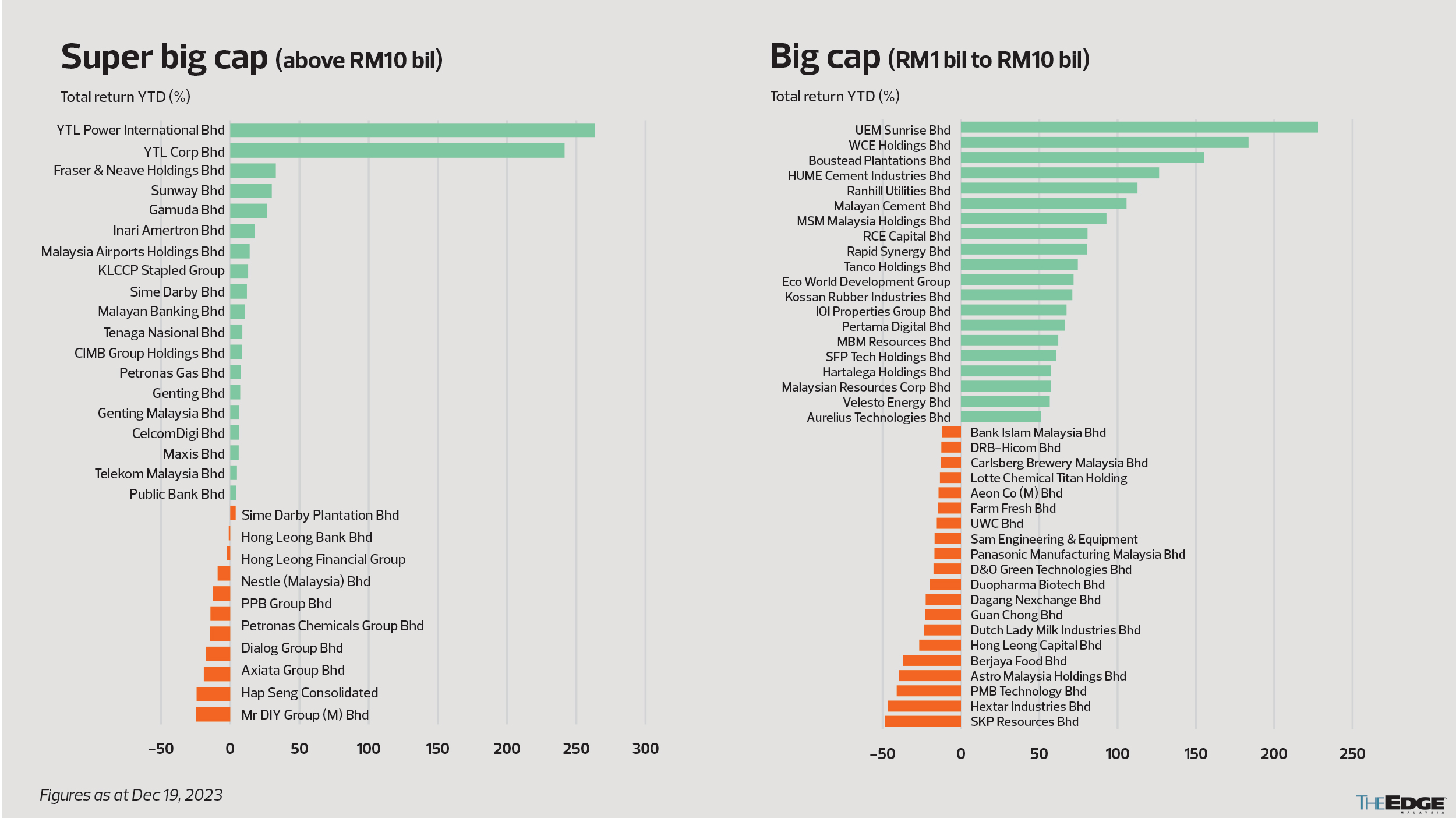

Super big cap (market cap of more than RM10 billion)

There are 30 companies in this category. At the top of the list were YTL Power International Bhd (+263.3%) and its parent company YTL Corp Bhd (+241.5%), both of which had a collective market capitalisation of RM41.75 billion. This was followed by Fraser & Neave Holdings Bhd (+32.9%). Selected companies in the property sector also emerged as star performers, including KLCCP Stapled Group (+12.9%) and Gamuda Bhd (+26.5%).

FTSE Russell and Bursa Malaysia replaced two FBM KLCI constituents — Dialog Group Bhd and Westports Holdings Bhd — with YTL Corp and its 56%-owned subsidiary YTL Power on Dec 18.

Shares in companies with businesses in tourism — such as Sunway Bhd (+30%), Malaysia Airports Holdings Bhd (14%), Genting Bhd (+7.2%) and Genting Malaysia Bhd (+6.4%) — also soared as cooped-up travellers went on vacation.

There were fewer banks topping the list, however, with just Malayan Banking Bhd (+10.4%), CIMB Group Holdings Bhd (+8.5%) and Public Bank Bhd (+3.9%) recording gains this year.

Utilities companies such as Tenaga Nasional Bhd (+8.7%) and Telekom Malaysia Bhd (+4.2%) as well as telecommunications players CelcomDigi Bhd (+6.1%) and Maxis Bhd (+4.8%) also recorded gains.

Among the top losers this year were Mr DIY Group (M) Bhd and Hap Seng Consolidated Bhd, which fell 24.7% and 24.3% YTD respectively. Axiata Group Bhd and Dialog Group Bhd were the next biggest laggards, having lost 19.1% and 17.7% respectively.

Big cap (RM1 billion to RM10 billion)

Over in the big-cap space, property players emerged as 2023’s biggest gainers, with UEM Sunrise Bhd topping the list (+227.9%), followed by Eco World Development Bhd (+71.9%), IOI Properties Group Bhd (+67.4%) and Tanco Holdings Bhd (+74.6%).

Construction companies also made the top gainers’ list, which included WCE Holdings Bhd (+183.6%), HUME Cement Industries Bhd (+126.5%), Malayan Cement Bhd (+105.7%) and Malayan Resources Corp Bhd (+57.5%).

Other firms that garnered handsome gains included Boustead Plantations Bhd (+155.4%), Ranhill Utilities Bhd (+112.7%), MSM Malaysia Holdings Bhd (+92.9%) and RCE Capital Bhd (+80.8%).

The top three losers were SKP Resources Bhd (-48.4%), Hextar Industries Bhd (-46.6%) and PMB Technology Bhd (-41%). Other losers included media and entertainment company Astro Malaysia Holdings Bhd (-39.7%), as well as consumer companies Berjaya Food Bhd (-37.1%), Dutch Lady Milk Industries Bhd (-23.7%), Carlsberg Brewery Malaysia Bhd (-13%), AEON Co (M) Bhd (-14.3%) and Farm Fresh Bhd (-14.8%).

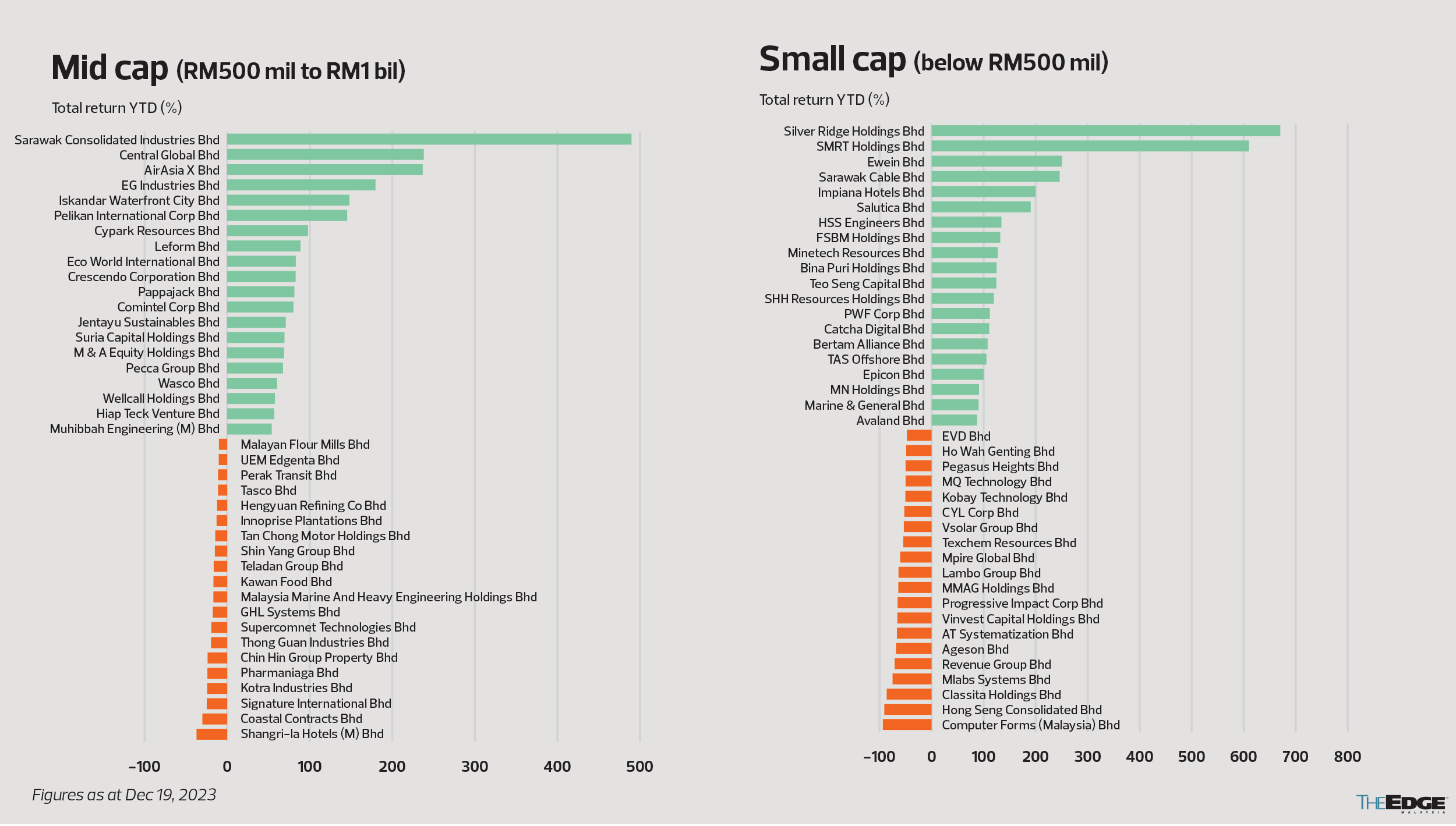

Mid cap (RM500 million to RM1 billion)

Construction company Sarawak Consolidated Industries Bhd topped the mid-cap category, with gains of 489.7%, followed by Central Global Bhd (+238.1%) and AirAsia X Bhd (+236.8%).

Other firms that made the top gainers’ list included engineering outfit Muhibbah Engineering (M) Bhd (+54%), pawnbroker Pappajack Bhd (+81.4%), as well as property developers Iskandar Waterfront City Bhd (+148.1%) and Eco World International Bhd (+83.1%).

Leather upholstery maker Pecca Group Bhd (+67.6%) chalked up handsome gains, thanks to a 55.8% surge in net profit to RM13.01 million for its first financial quarter ended Sept 30, 2023 (1QFY2024), from RM8.35 million a year earlier.

Among the top losers in the mid-cap category were Shangri-la Hotels (M) Bhd and Coastal Contracts Bhd, whose shares slipped 37.1% and 30% respectively YTD. The counters of tycoon Datuk Seri Chiau Beng Teik — Chin Hin Group Properties Bhd (-23.7%) and its unit Signature International Bhd (-24.7%) — reversed their gains from +30% and +87% respectively last year.

Small cap (below RM500 mil)

Top gainers in the small-cap category included Silver Ridge Holdings Bhd (+670.4%), SMRT Holdings Bhd (+610.3%), Ewein Bhd (+250.7%) and Sarawak Cable Bhd (S-Cable) (+246.2%).

The tide appears to be turning for S-Cable, after investment and corporate advisory company Serendib Capital Ltd emerged as a white knight for the financially troubled firm. According to S-Cable, Serendib will inject RM250 million to revive the cable manufacturer’s coffers.

The news sparked investor interest and pushed S-Cable’s share price up four times to 25 sen, from six sen prior to the announcement on Dec 12. According to S-Cable, the board received the offer on Dec 5 and accepted the broad terms of the proposal investment by Serendib. A formal agreement between the parties has yet to be signed.

Another top gainer was egg producer Teo Seng Capital Bhd (+124.6%), which experienced a surge in net profit for the third quarter ended Sept 30, 2023, of more than 84 times to RM43.83 million from RM516,000 a year ago, boosted by higher average selling prices and quantity of eggs sold.

The 3QFY2023 net profit is already more than double the group’s full-year net profit of RM21.64 million in FY2022, and also its highest quarterly profit recorded since its listing in 2008. Teo Seng said subsidies from the government, which cushioned the impact of high feed costs, also contributed to the surge in quarterly earnings.

Top losers included Computer Forms (M) Bhd (-93.8%), Hong Seng Consolidated Bhd (-90.9%) and Classita Holdings Bhd (-86.3%).

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| AAX | 1.530 |

| AEON | 1.110 |

| AIRPORT | 9.940 |

| ASTRO | 0.310 |

| AXIATA | 2.800 |

| BJFOOD | 0.675 |

| BPLANT | 1.570 |

| BURSA | 7.450 |

| CARLSBG | 18.580 |

| CDB | 4.180 |

| CFM | 0.140 |

| CFM-WA | 0.015 |

| CGB | 0.840 |

| CGB-WA | 0.640 |

| CHINHIN | 5.300 |

| CIMB | 6.610 |

| CLASSITA | 0.040 |

| CLASSITA-WC | 0.010 |

| COASTAL | 1.500 |

| DIALOG | 2.430 |

| DLADY | 33.820 |

| EWEIN | 0.900 |

| EWINT | 0.360 |

| F&N | 31.600 |

| FBMKLCI | 1582.660 |

| FFB | 1.500 |

| GAMUDA | 5.360 |

| GENM | 2.630 |

| GENTING | 4.540 |

| HAPSENG | 4.440 |

| HEXIND | 0.365 |

| HONGSENG | 0.010 |

| HONGSENG-PA | 1.740 |

| HONGSENG-WA | 1.180 |

| HONGSENG-WB | 0.005 |

| HUMEIND | 2.800 |

| IOIPG | 2.160 |

| IWCITY | 0.750 |

| MAXIS | 3.640 |

| MAYBANK | 9.750 |

| MCEMENT | 5.070 |

| MRDIY | 1.570 |

| MSM | 3.230 |

| MUHIBAH | 0.925 |

| PBBANK | 4.180 |

| PECCA | 1.310 |

| PMBTECH | 2.680 |

| PPJACK | 1.000 |

| RANHILL | 1.100 |

| RCECAP | 2.800 |

| SCABLE | 0.155 |

| SCIB | 0.295 |

| SIGN | 1.220 |

| SKPRES | 1.040 |

| SKPRES-WB | 0.055 |

| SMRT | 0.825 |

| SRIDGE | 0.330 |

| SUNWAY | 3.490 |

| SUNWAY-WB | 2.090 |

| TANCO | 0.825 |

| TENAGA | 11.920 |

| TEOSENG | 1.780 |

| TM | 6.130 |

| UEMS | 1.090 |

| WCEHB | 0.905 |

| WPRTS | 3.900 |

| YTL | 3.200 |

| YTLPOWR | 4.790 |

Comments