Astro logs fourth straight profitable quarter on favourable forex, lower amortisation of assets

KUALA LUMPUR (Dec 11): Astro Malaysia Holdings Bhd (KL:ASTRO) made a net profit of RM46.94 million for its third quarter ended Oct 31, 2024 (3QFY2025) — its fourth consecutive quarter in the black, as opposed to a net loss of RM47.05 million incurred in 3QFY2024.

The profit recorded was due to lower net financing costs from favourable unrealised foreign exchange (forex) gains on unhedged lease liabilities, and lower intangible asset amortisation, the group said in a bourse filing on Wednesday.

These were partially offset by a lower earnings before interest, taxes, depreciation and amortisation (Ebitda) and higher tax expense, said the pay TV service provider. Ebitda margin dipped 1.2% year-on-year, dragged by higher broadband and content costs, as well as higher marketing and distribution expenses.

Quarterly revenue slipped 9.52% to RM749.70 million, compared with RM828.55 million a year earlier, primarily due to lower subscription revenue and advertising revenue.

Its earnings per share amounted to 0.9 sen, as opposed to a loss per share of 0.9 sen in 3QFY2024. No dividend was declared.

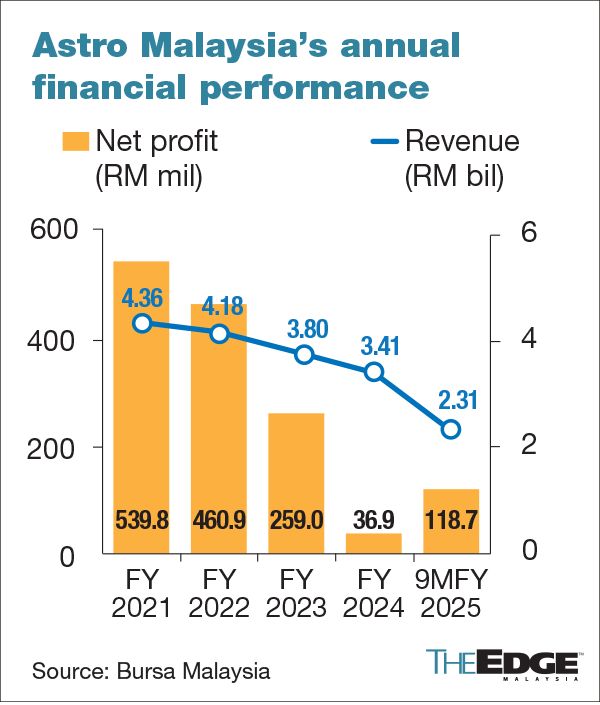

For the first nine months of FY2025, Astro recorded a net profit of RM118.66 million versus a net loss of RM7.51 million in the same period of FY2024, largely due to the same reasons that led to its profitable 3QFY2025. Cumulative revenue for the period, however, dropped 8.46% to RM2.31 billion from RM2.52 billion on lower subscription and advertising revenues.

Ebitda margin dropped 2.3% year-on-year due to higher broadband and content costs, licences, copyright and royalty fees, and selling and distribution expenses.

Astro said content piracy remains its biggest challenge. As of November this year, Astro said it had removed 514,000 illegal links from a variety of websites, social media, mobile apps, and e-commerce sites, including the shuttering of 250 Telegram groups with a combined 10 million subscribers.

“We released our inaugural 1HFY2025 Anti-Piracy Report Card detailing our initiatives, actions and wins through a combination of fines, settlements, and prosecution. We are hopeful that a recent landmark decision, with the court awarding Astro statutory damages without prior settlement for the first time ever, sends a strong message to businesses to stop engaging in piracy and breaching copyright,” it said.

Astro group chief executive officer Euan Smith said the company is committed to providing affordable and meaningful entertainment solutions for Malaysians amid higher living costs.

“We remain steadfast in our mission to be Malaysia’s No 1 entertainment and streaming destination. Even as we navigate consumer headwinds, our focus remains on growing new customers, strengthening adjacent businesses, and reducing legacy costs,” Smith said.

Astro shares closed one sen or 4.44% higher at 23.5 sen on Wednesday, giving the group a market capitalisation of RM1.23 billion. The stock has dropped over 38% year to date.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| ASTRO | 0.220 |

Comments