Sabah’s high-stakes electricity overhaul

This article first appeared in The Edge Malaysia Weekly on March 10, 2025 - March 16, 2025

IN Lahad Datu on the east coast of Sabah, a 400 megawatt-hour (MWh) battery storage project is set to be Asean’s largest to be commissioned to date. To be completed in July, the project is also the first in Malaysia, putting Sabah ahead of the other states in setting up such an infrastructure.

The battery energy storage system (BESS) is one of many efforts explored by Sabah to address the state’s low electricity reserve margin of around 15% currently (versus Peninsular Malaysia’s circa 30%), its power interruption of over three hours a year (versus 35 minutes in the peninsula), and its reliance on subsidies, which amounted to RM866 million in 2024. At 15%, the electricity reserve margin is an improvement from the 5% it stood at at the end of last year.

Deemed expensive in other markets like Peninsular Malaysia, the cost per kilowatt-hour of BESS is acceptable in Sabah. This is because the state still uses pricier diesel and medium fuel oil (MFO), partly due to the lack of access to gas supply in the east coast despite the state contributing north of 12% of the country’s gas production.

“We need to have a holistic approach and, more importantly, it has to be customised to Sabah’s needs and aligned to its socio-economic development according to the current situation we are in,” says Energy Commission of Sabah (Ecos) chief executive officer Datuk Abdul Nasser Abdul Wahid in an exclusive interview with The Edge.

The challenge mounts for a state which only recently secured autonomy in its electricity sector from the federal government, as part of the enforcement of Malaysia Agreement 1963.

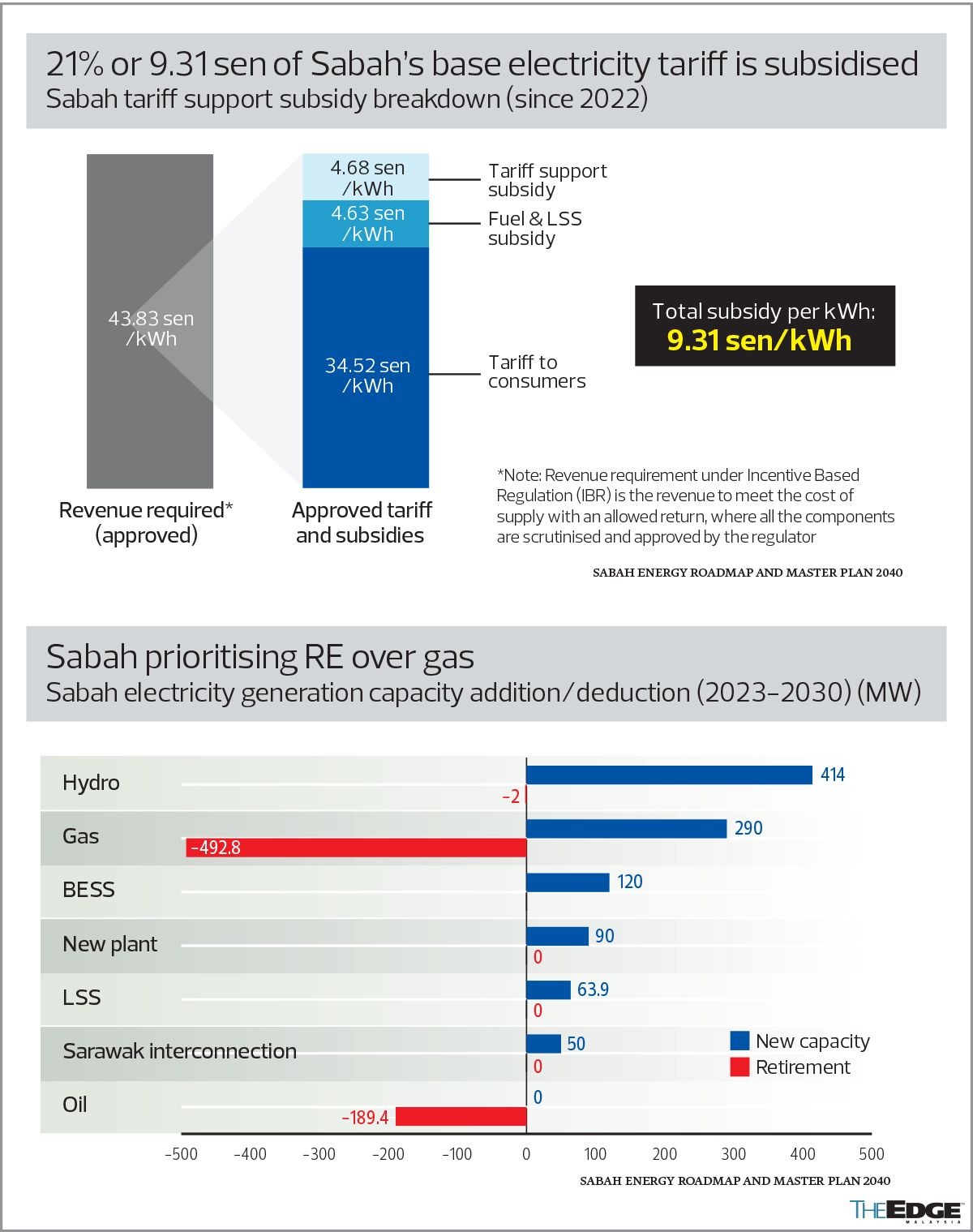

At 34.52 sen per kilowatt-hour (kWh), Sabah’s base electricity tariff is the lowest in the region. Its average cost of 43.83 sen per kWh is about 21% higher than the selling price — which hinders cost-recovery and slows down infrastructure development, resulting in outages — even in the capital, Kota Kinabalu.

Furthermore, the many changes of government have not helped in speeding up project rollouts. One example is the controversial 662km, RM4.06 billion Trans-Sabah Gas Pipeline project, which was mooted in 2016 by the Barisan Nasional government. It was supposed to supply gas from the west coast to power up a proposed gas power plant on the east coast. In 2018, the project was scrapped by the Pakatan Harapan administration amid reports of a lofty upfront payment despite little construction progress. The project, later said to be one of several awarded to Chinese companies in return for bailing out 1Malaysia Development Bhd, was revived by the Perikatan Nasional administration in 2021. It was scrapped again by the current PH-BN government, according to a Feb 19 parliamentary written reply from the Ministry of Economy.

Thus, with Sabah’s regulatory autonomy — like what Sarawak has enjoyed since 1963 — the decision-making process for the state’s power sector planning is off to a quick start.

Notwithstanding debates about the direct award of the RM645 million BESS project, its July commissioning deadline is less than one year after it was dished out in September 2024. The project, owned by state-linked utility firm Sabah Electricity Sdn Bhd (SESB), is constructed by a unit of Seal Incorporated Bhd (KL:SEAL).

Also in September, SESB was awarded a RM700 million, 94mw gas power plant project. In December, the state awarded 199mw of large-scale solar (LSS) projects to 15 bidders, half of which were Sabah state-linked companies.

In the interim, to address service reliability issues, Ecos has opted for fast-track solutions that will be gradually phased out when the permanent projects come online, explains Abdul Nasser. “For example, the renting of additional diesel generators to about 100mw. This is done,” he says. Ecos is also initiating the renting of 100mw of gas-powered generators. These will later give way to the gas-fired power plant built by SESB.

This month, Eden Inc Bhd (KL:EDEN) secured an extension of its MFO power plant power purchase agreement, with a capacity of up to 45mw, to February 2027. Sarawak is also expected to start exporting 30mw of electricity to Sabah under the Northern Grid Extension Project starting next quarter, with plans to increase the capacity in stages. All these, together with the BESS storage to address peak demand, will lift the state’s reserve margin to up to 30% by July, Abdul Nasser adds.

In addressing the west-east imbalance, upgrading of the sole west-east interconnection (East Coast Transmission project) to export more electricity from the west should be completed in the next quarter. A decision on a 330km Southern Link — which is expected to take five years to develop — is also expected this year. It will complete the state grid and optimise power generation with the least cost option from any area in Sabah.

In the longer term, the state wants to move away from peaking plants that use diesel and have more hydropower plants as baseload power sources. While domestic gas supply is increasingly being channelled into other strategic sectors such as industrial and petrochemicals, gas-fuelled power generation still remains in the picture. To address supply issues among industry players, it is a policy of the state government to allow players to have their own power generation capacity in certain cases, Abdul Nasser says.

“When an investor comes in, we don’t want [a situation where] because of power, they cannot build their factory. [But] We have to look at the whole of Sabah’s economic development. Power is just one of the elements.

“The new gas plants are peakers (plants that run only when there is high electricity demand) … they run eight hours a day and you use less gas, and that will allow more gas to be used by the industries. That’s the game plan,” he adds.

As for other renewable energy (RE) projects, Ecos is eyeing 600mw more of solar capacity, which would require a “similarly substantial amount of BESS”, as the existing grid would have reached the maximum amount of intermittent energy it can take following the latest LSS awards. A rule of thumb is to have intermittent supply amounting to 20% of demand.

“What’s important about hydro and other RE projects is that moving forward, they do not require subsidies. So it is part of the subsidy rationalisation — it’s not just about fixing the tariffs, but fixing the generation costs, moving away from over-dependence on subsidies.

“Of course, the tariffs need to be corrected … but you have to safeguard the respective customer segments,” he adds.

Tariff headwinds, leakages

The hydropower plant projects announced in Sabah include the 187.5mw Ulu Padas hydroelectric dam. Gamuda Bhd’s (KL:GAMUDA) 45%-owned joint venture was appointed the contractor for the RM3.05 billion project set for commissioning in 2030. Meanwhile, Jentayu Sustainables Bhd (KL:JSB) in September received a letter of notification from Ecos for the development of a 162mw run-of-river hydro plant dubbed Project Oriole for commissioning in 2028. There has been little update from Jentayu, which has yet to chart a clear pathway to its restructuring plan and remains loss-making. That said, the target is to achieve financial close in March and to get the project off the ground by June, says Mohd Yaakob Jaafar, CEO of SESB, which has 20% equity interest in the project on behalf of the state.

“The project is on track,” he adds. “The game changer is in reducing the cost of diesel.”

In total, the state is eyeing 2,000mw of potential hydro generation by 2037, representing 38% of Sabah’s grid generation capacity mix to reduce over-dependence on gas to about 40%, from more than 80% today — and, more importantly, removing diesel and MFO entirely by 2030.

Consider that the July-bound BESS is estimated to be over 30% cheaper than diesel on a per kWh basis. Diesel, together with MFO, represents 10% of the state’s generation mix and remains in use today.

Replacing the two fuel oils with cheaper generation sources would remove close to half of the entire subsidy, not including removal of rent costs for the interim generators, says Ecos’ Abdul Nasser.

But another component is tariff support subsidy as the base tariff is lower than costs, even before including additional fuel expenses under the imbalance cost pass-through mechanism. On top of that, like in Peninsular Malaysia, Sabah’s power sector also enjoys discounted piped gas prices. Adjusting gas prices to market prices would further widen the gap between tariffs and power generation, transmission and distribution costs.

Since the privatisation of the state’s utility outfit Sabah Electricity Board to SESB in 1998, the state has only seen two tariff revisions — in 2011 and 2014.

Last year, SESB chairman Datuk Seri Wilfred Madius Tangau flagged in his column in a state publication that SESB was facing difficulties in sourcing the RM886 million in subsidies from the federal government due to the latter’s tight financial position.

“In addition, we are losing RM60 million per year through theft by [those living in] the 280-odd squatter areas around the state. Another RM140 million is lost either through theft by non-squatters or consumers who simply avoid paying,” he was quoted as saying. That is about 7% of electricity generated, on top of 10% “system loss” due in part to old infrastructure. The state conducted 21 raids in 2024 and SESB’s civil claims in 2024 alone amounted to RM18 million in more than 3,000 cases.

And with Sabah heading for a state election this year, enforcement remains a challenge, as is the case with the tariff hikes in Peninsular Malaysia, where the authorities are struggling to address adjustments initially scheduled for this July.

According to Tenaga Nasional Bhd (KL:TENAGA)’s 2023 annual report, Sabah had just 1,661 industrial customers as opposed to 34,390 in Peninsular Malaysia, and just 107,624 commercial customers versus the peninsula’s 1.69 million at the end of the 2023. In the financial year ended Dec 31, 2023, SESB posted RM111.64 million in net profit on RM2.77 billion in revenue. Its transmission and distribution earnings are regulated by Ecos.

Without the subsidies, the group, which is 82.75%-owned by Tenaga and 17.24%-owned by the Sabah government, would surely be in the red and would have no buffer to look at improving its transmission and distribution network. The state’s network still heavily features bare or non-insulated conductors, for example, which would require up to RM4 billion to replace entirely. In comparison, transmission and distribution capex under SESB averages about RM400 million per year.

The state is scheduled to take over Tenaga’s stake in SESB come 2030, which could open doors for other possibilities such as a public listing. But this will not be sustainable under the current tariff arrangement.

SESB’s Yaakob says the utility firm is working on multiple fronts to reduce interruptions, speed up restoration and improve accessibility, including upgrading smaller substations for automated switching in case of tripping, and exploring off-grid solutions for the more challenging geographical areas. It is also a state policy to allow industrial players in certain areas to have their own power-generation capacity.

Nonetheless, closing the tariff gap would be critical in ensuring SESB is able to achieve service excellence, he says. “To meet customer expectations, comparing us with other regional players, we accept the challenge. To provide service excellence, our costs must be compensated accordingly. If our tariff is below cost, it is difficult for us to achieve that.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments