Lim family scoops up battered Genting shares

KUALA LUMPUR (March 12): Tan Sri Lim Kok Thay and his family bought Genting Bhd (KL:GENTING) shares for the first time in nearly four years, in what analysts see as a massive show of support for the heavily-battered stock.

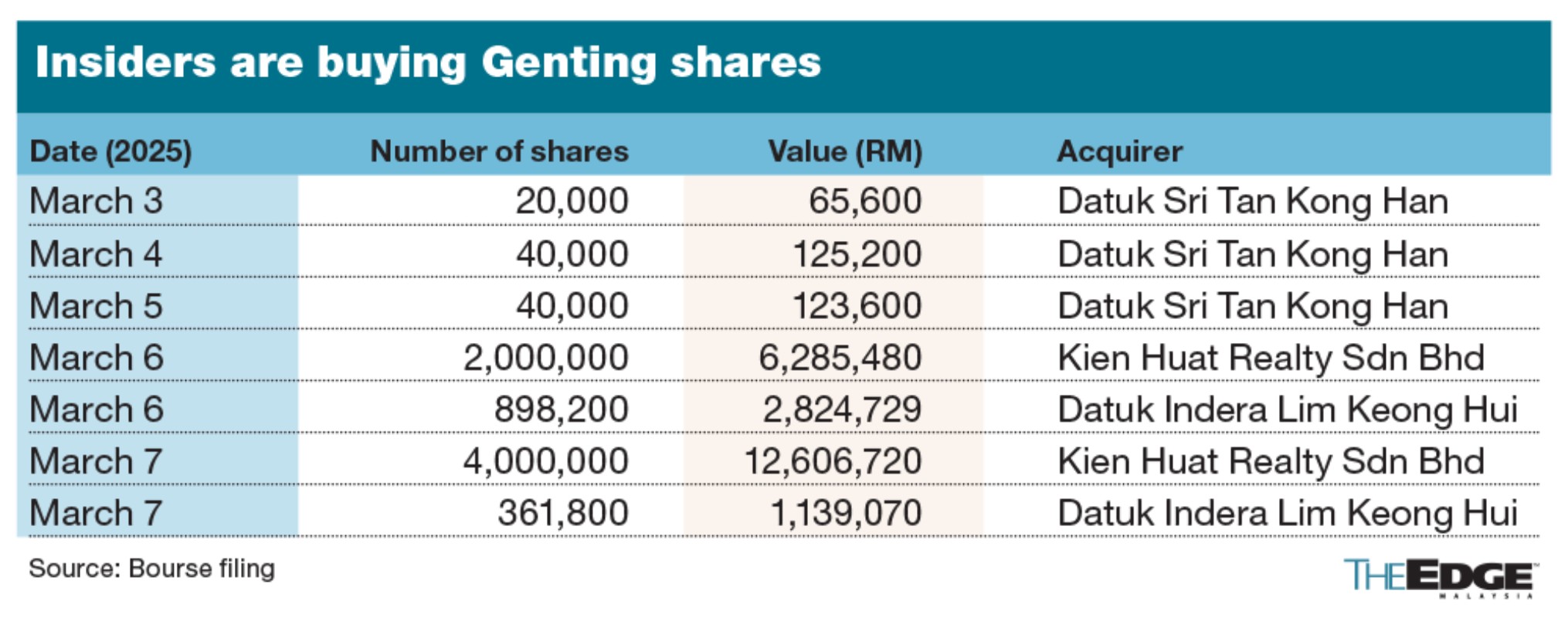

Over the past week, the Lim family has purchased 7.26 million Genting shares worth RM22.86 million. Lim’s private investment vehicle Kien Huat Realty Sdn Bhd has scooped up six million shares, while his son Keong Hui separately bought 1.26 million shares.

The share purchases by the Lim family demonstrate strong support for Genting after its shares lost as much as 18% of their value since the release of its financial results at the end of February, analysts said.

The acquisitions, at valuations near historic lows, instil confidence that the share price may have already factored in all potential negatives, said Maybank Investment Bank analyst Samuel Yin Shao Yang who upgraded the stock to "buy" on Wednesday.

Prior to the latest acquisitions, the Lim family’s last recorded purchase of Genting shares was in June 2020. Datuk Seri Tan Kong Han, who is set to succeed Kok Thay as Genting’s chief executive officer, has also purchased 100,000 Genting shares worth RM341,400 over the past week.

Shares of Genting have bounced off their four-year lows on March 5, reducing the year-to-date loss to about 15%. Investors have been worried about potentially lower dividends, particularly from its key subsidiary Genting Malaysia Bhd (KL:GENM).

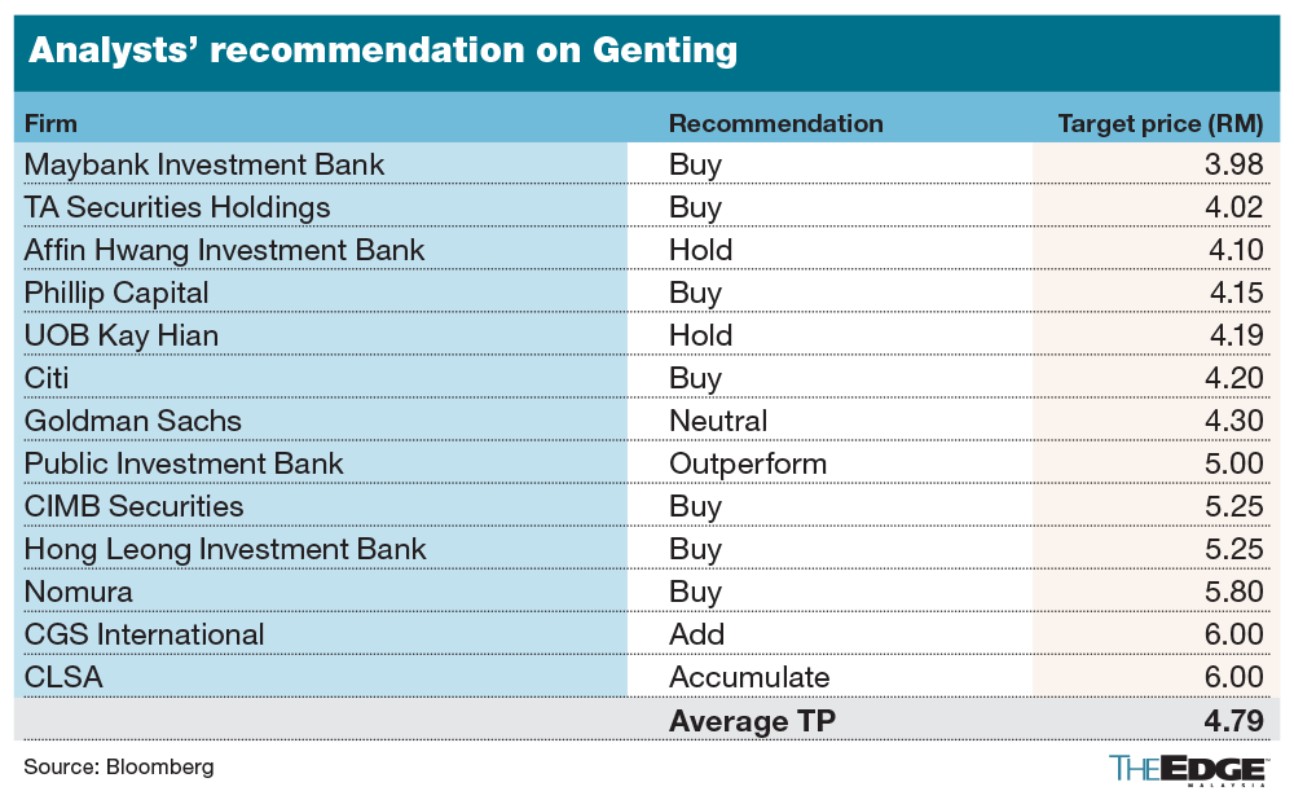

Analysts meanwhile are largely optimistic, with ten "buy", three "hold" and no "sell" calls. The average target price of RM4.79, according to Bloomberg, suggests a potential upside of 47% from its current price of RM3.26.

While acknowledging the gesture as a show of support, UOB Kay Hian’s head of strategy Vincent Khoo cautioned about the lack of participation from minority investors.

In the current depressed market conditions, a cut in dividends could deter minority investors from following through, he said.

The Lim family and Tan did not purchase shares of Genting Malaysia, which has suffered a 24% decline in its share price after poorer than expected results and deletion from the MSCI Malaysia Index.

Genting Malaysia had declared a lower dividend for 2024 as part of its strategy to conserve cash for expansion and investment, according to several analysts who attended a post-earnings briefing with the company’s management.

The company’s resorts in New York City would need an estimated US$5 billion for expansion if its bid for downstate casino licence is successful, while the company may require another capital outlay of US$3 billion if it manages to secure a licence in Thailand.

Genting Malaysia's exclusion from the main MSCI country index was effective at the close of Feb 28. MSCI indices are closely watched by fund managers and foreign investors. An exclusion from the indices can trigger outflows, as passive investors sell the former constituent in their portfolios to mirror the benchmarks.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments