Cover Story: Is Malaysia’s chip sector prepared for the storm?

This article first appeared in The Edge Malaysia Weekly on January 20, 2025 - January 26, 2025

IN the name of “US national security and economic strength”, the Biden-Harris administration on Jan 13 released an Interim Final Rule on Artificial Intelligence Diffusion. This rule imposes new restrictions on the export of US-developed chips that power artificial intelligence (AI) systems. The announcement comes just a week before Joe Biden exits the White House, ahead of president-elect Donald Trump’s second inauguration on Monday (Jan 20).

The new rule, which introduces a three-tier licensing framework for semiconductors used in data centres handling AI computations, has sent shockwaves through the global semiconductor supply chain.

Countries in the top tier, including Australia, New Zealand, South Korea, Taiwan, the Netherlands and Ireland, face no restrictions. In contrast, nations such as China, Iran, Russia and North Korea are effectively barred from importing AI chips from US companies.

The middle tier, which reportedly includes Malaysia, comprises more than 100 countries subject to export caps and licensing requirements.

The Semiconductor Industry Association (SIA) and Nvidia Corp — two powerful voices in the global chip industry — have strongly criticised the Biden administration’s new export curbs on AI chips.

“We’re deeply disappointed that a policy shift of this magnitude and impact is being rushed out the door days before a presidential transition and without any meaningful input from the industry.

“The new rule risks causing unintended and lasting damage to America’s economy and global competitiveness in semiconductors and AI by ceding strategic markets to our competitors,” said SIA president and CEO John Neuffer in a statement on Jan 13.

Meanwhile, Ned Finkle, Nvidia vice-president of government affairs, condemned the Biden administration for undermining America’s leadership with a more than 200-page “regulatory morass”, “drafted in secret” and “without proper legislative review”.

“By attempting to rig market outcomes and stifle competition — the lifeblood of innovation — the Biden administration’s new rule threatens to squander America’s hard-won technological advantage. While cloaked in the guise of an ‘anti-China’ measure, these rules would do nothing to enhance US security,” he warned.

Ready or not, the new rules have now entered a 120-day comment period, meaning they will take effect within four months from publication, giving the incoming Trump administration time to intervene.

It is anticipated that the Trump administration will use this time to gather feedback from experts, industry stakeholders and partner nations, potentially implementing changes based on their input.

For one, Nvidia CEO Jensen Huang had reportedly expressed readiness to meet Trump and offer his assistance to the incoming administration. The tech mogul has openly objected to Biden’s proposal, stating that the curbs “would not reduce the risk of misuse but would threaten economic growth and US leadership”.

While it remains to be seen how the situation will evolve under the new Trump administration, the export curbs are already making waves in the chip industry.

What does this mean for Malaysia, which plays an important role in the global semiconductor supply chain, accounting for 13% of the world’s chip testing and packaging services? As the sixth-largest semiconductor exporter globally, the country holds a 7% global market share in this space.

Notably, Malaysia packages 23% of all American chips, reflecting its strong ties with US firms. These companies have been key investors in the Malaysian semiconductor sector, contributing to its growth and development over the past five decades.

Are Malaysian players along the semiconductor value chain well placed to navigate the uncertainty and emerging challenges ahead?

How diversified are Malaysian chip players?

Since the 1970s, US giants Intel Corp, Advanced Micro Devices (AMD) Inc, Hewlett-Packard (HP) and National Semiconductor Corp — four of “The Eight Samurai” that brought the first wave of electrical and electronics (E&E) manufacturing investments into Malaysia — have established their operations in Penang.

Between 1970 and 1980, the local semiconductor sector employed 15% of Malaysia’s workforce, with many securing well-paid jobs in electronics assembly.

Penang, a state that once faced economic despair after losing its free port status, eventually earned the nickname “Silicon Valley of the East”, owing to its strong and vibrant E&E ecosystem.

Nevertheless, the global chip industry has evolved significantly over the years, especially with the rise of Taiwan and, more recently, China as major players in the global semiconductor market.

For perspective, the E&E sector represents around 40% of Malaysia’s exports, generating RM575 billion in revenue in 2023. Malaysia’s top export destinations for E&E products in 2023 included Singapore, which accounted for 18.6% of exports, followed by the US (16.3%), China (15.2%), Hong Kong (13.1%), the European Union (8.5%) and Taiwan (4.9%).

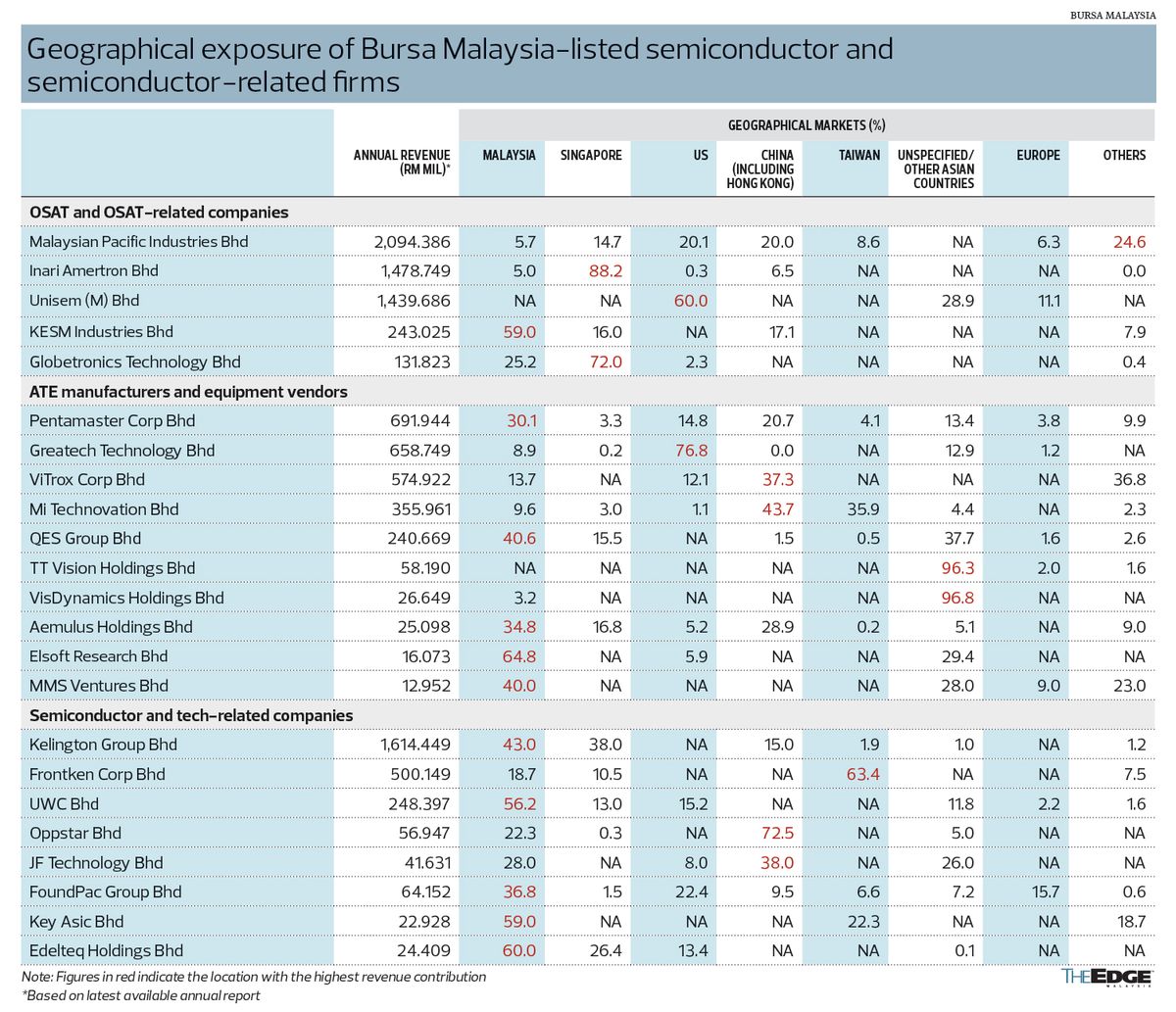

A closer look at the revenue sources of Bursa Malaysia-listed semiconductor and tech-related companies shows different strategies in managing their geographical risks.

While some have spread their revenue across key markets such as the US, China and Malaysia, others depend heavily on a single region or country, making them more vulnerable to geopolitical tensions and shifts in supply chains than their peers.

As global trade tensions, especially the US-China tech war, reshape supply chains and geopolitical risks cloud future growth, how well are Malaysia’s semiconductor companies positioned to weather these uncertainties? Which firms are getting it right, and which might be walking a tightrope?

In the outsourced semiconductor assembly and test (OSAT) segment, Inari Amertron Bhd (KL:INARI) stands out for its heavy dependence on Singapore, which contributes 88.2% of its revenue. It is an open secret that Inari has been heavily reliant on a US fabless chip vendor that operates its Asean sales office in the city state. Inari has also hedged itself, however, by partnering with a firm in China to carry out OSAT activities for the Chinese market in its Kunshan plant.

Similarly, Unisem (M) Bhd (KL:UNISEM) draws 60% of its turnover from the US, which, at first glance, seems to indicate a single market concentration risk. Nevertheless, it should be noted that Unisem also operates a plant in Chengdu, China, which allows the group to capture and serve customers in different markets. In fact, about 29% of its top line comes from unspecified Asian countries.

Meanwhile, Malaysian Pacific Industries Bhd (KL:MPI) demonstrates a more diversified revenue base, with contributions spread across the US (20.1%), China (20%) and others (24.6%).

The automated test equipment (ATE) segment also presents contrasting strategies. Greatech Technology Bhd (KL:GREATEC) derives 76.8% of its revenue from the US, underscoring its reliance on a single dominant market, as well as potential exposure to geopolitical and economic risks.

On the other hand, automation house Pentamaster Corp Bhd (KL:PENTA) displays a more balanced distribution, with revenue contributions from Malaysia (30.1%), China (20.7%) and the US (14.8%).

Similarly, equipment giant ViTrox Corp Bhd (KL:VITROX) also demonstrates a relatively diversified geographical mix, with significant contributions from China (37.3%) and other markets (36.8%), alongside Malaysia (13.7%) and the US (12.1%).

In the broader semiconductor and tech-related segment, Kelington Group Bhd (KL:KGB), which provides ultra-high purity gas delivery solutions to wafer fabrication plants, emerges as a relatively diversified player, with revenue contributions from Malaysia (43%), Singapore (38%) and China (15%).

In contrast, home-grown chip design house Oppstar Bhd (KL:OPPSTAR) relies heavily on China (72.5%), while surface treatment and mechanical engineering solutions provider Frontken Corp Bhd (KL:FRONTKN) sees 63.4% of its revenue derived from Taiwan.

Smaller players such as KESM Industries Bhd (KL:KESM), Elsoft Research Bhd (KL:ELSOFT), Edelteq Holdings Bhd (KL:EDELTEQ) and Key Asic Bhd (KL:KEYASIC) display market concentration in Malaysia, which contributes on average 60% of their turnover.

Overall, based on the data compiled by The Edge, 11 companies have the highest revenue contribution from Malaysia, while four companies rely on China the most for their top line.

Meanwhile, Inari and Globetronics Technology Bhd (KL:GTRONIC) see their largest revenue share from Singapore, whereas Greatech and Unisem are most exposed to the US. Only Frontken derives its largest revenue share from Taiwan.

While reliance on a single dominant market or region may appear risky initially, it is not necessarily a disadvantage. In fact, for many Malaysian semiconductor firms, their strategic focus on key markets such as the US, China or Singapore often stems from long-standing, mutually beneficial relationships with major clients.

These foreign clients, many of whom are global tech giants, also rely on Malaysian firms to carry out essential activities and services, such as testing, packaging and assembly. The complexity of these operations, combined with specialised capabilities and established infrastructure, makes it difficult for them to replace these local vendors and service providers overnight.

In that sense, the deep integration of these local firms into the global supply chain offers a level of stability, even in the face of shifting geopolitical dynamics.

Capitalising on shifts in demand

ViTrox co-founder and senior executive vice-president Steven Siaw Kok Tong estimates that two-thirds of the ATE firm’s business were derived from two major regions — China and North America, comprising the US and Mexico — in the financial year ended Dec 31, 2024 (FY2024). The next biggest contributor was Malaysia, followed by the rest of the world.

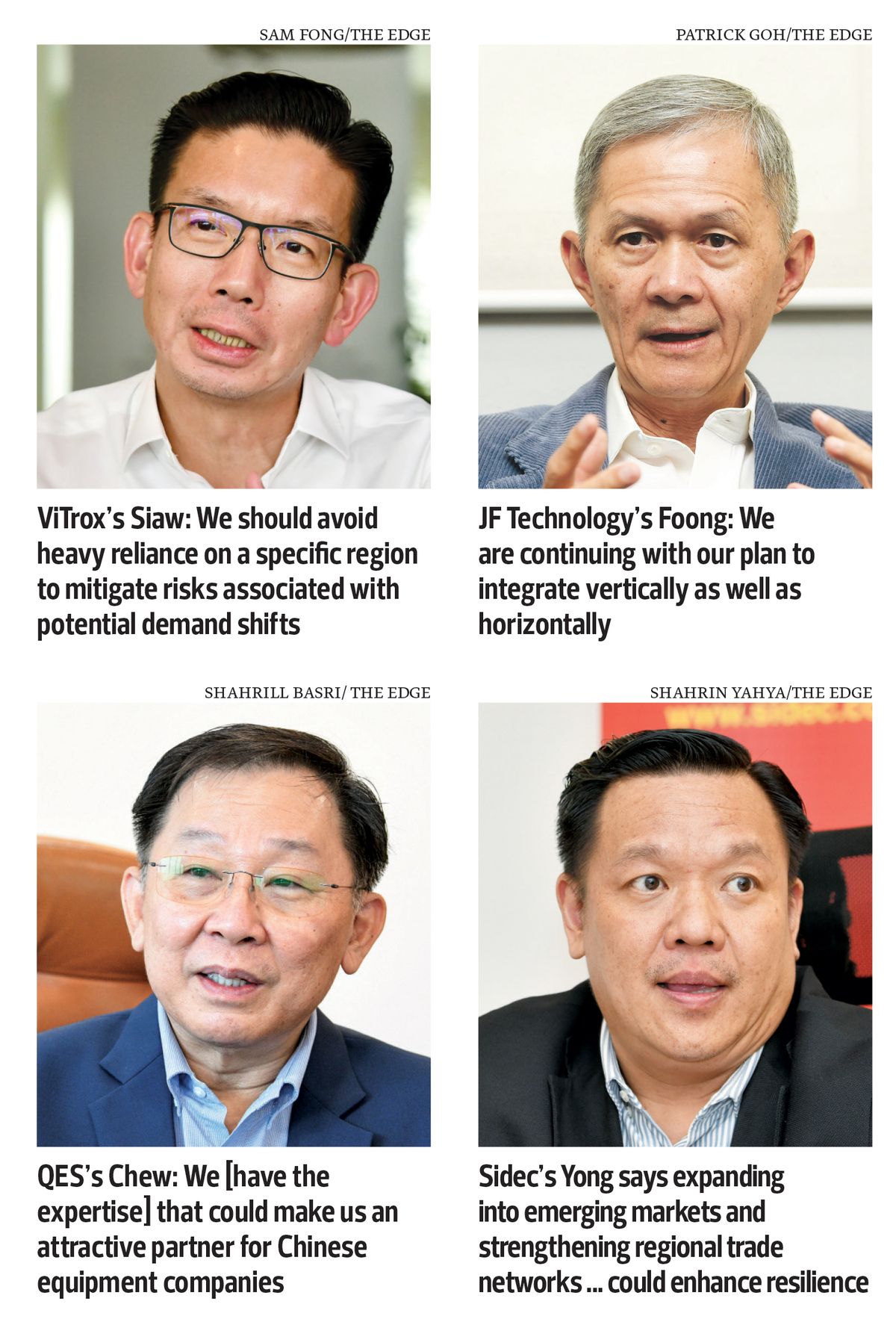

“Demand from these two major regions (China and North America) can be both complementary and mutually exclusive, depending on changes in geopolitics, policy shifts and risk management. We are fairly comfortable with our current geographical distribution, although we need to be constantly looking out for evolving changes, and respond in a timely and appropriate manner,” he tells The Edge.

Because of these uncertainties, Siaw says, it is vital to establish a strong presence not just in mature markets, but also in growth and emerging regions such as Vietnam and India to capitalise on potential demand shifts.

“We should avoid heavy reliance on a specific region to mitigate risks associated with potential demand shifts.

“Sound strategic moves include establishing local presence in various geographical regions, partnership with trustworthy and dependable business associates, establishing an alternative and a reliable supply chain, and training up sufficient resources to provide local response and support when required,” he adds.

Besides its headquarters in Batu Kawan, Penang, ViTrox also has worldwide research and development (R&D) sites and subsidiaries in Germany, China and the US.

JF Technology Bhd (KL:JFTECH) co-founder and managing director Datuk Foong Wei Kuong says the current US-China trade tensions present both challenges and opportunities for Malaysian semiconductor-related firms.

According to him, while the tensions have caused disruptions to global supply chains and raised uncertainty, they have also led to increased demand for semiconductors from Southeast Asia as companies seek to diversify their sourcing and manufacturing operations. Local companies stand to benefit from the opportunities arising from Malaysia’s continued neutral stance.

Foong tells The Edge: “We have a diversified revenue stream, as we serve a diverse clientele of more than 100 multinational corporations. Geographically, we also have a manufacturing presence in Kunshan, capitalising on the vast opportunities there.

“We are also starting to further strengthen our market share in the US in collaboration with our US partner. Looking ahead, we continue to enhance our geographical presence and capabilities to remain at the forefront of technology and navigate any future adversities.”

JF Technology, a test contacting solutions specialist, had announced plans in October 2020 to team up with Hubble Technology Investment Co Ltd (HTI) — a unit of its Chinese partner Huawei Investment & Holding Co Ltd — to set up a plant in Kunshan, in Jiangsu province, China.

The company is also slated to start selling and distributing its products in the US by this month, following a cross-licensing agreement signed with US-based Ironwood Electronics last July.

As a player in the semiconductor value chain, says Foong, new market expansion, strategic partnerships, customer base diversification and potentially establishing regional manufacturing hubs are important strategic considerations to maintain and enhance competitive advantages.

“We are continuing with our plan to integrate vertically as well as horizontally. JF Tech is riding on both organic and inorganic growth. We are widening our product offerings and strengthening our capabilities while exploring synergistic merger and acquisition (M&A) opportunities to enhance our position in the semiconductor value chain,” he says.

QES Group Bhd (KL:QES) co-founder and managing director Chew Ne Weng points out that semiconductor integrated circuit (IC) design, wafer fabrication, test assembly manufacturing as well as material and equipment technology are sectors susceptible to the US-China trade tensions.

Over the past few years, the Chinese government has invested significantly in financial and human resources to reduce its reliance on the US-led semiconductor material and equipment supply chain.

Similarly, the US government is offering funding subsidies through the CHIPS Act to support semiconductor companies in onshoring their expansions, reversing the long-standing trend of offshoring motivated by lower costs.

Chew says: “Both the world’s largest and second-largest economies are putting up trade barriers to keep their respective domestic markets while pushing forward ‘economic patriotism’, if there is such a term to describe this.”

While the majority of Malaysian OSAT clientele are focused on the US and Europe, some have been operating plants in China for many years.

“In a way, these Malaysian OSATs have already mitigated geopolitical risks by establishing manufacturing locations across Asean and China,” Chew says. “With Trump 2.0 looming, where we expect high tariffs to be imposed on China-made products, many Malaysian semiconductor companies are likely to operate at least two sites — one in China for the domestic market, and another in Asean for the US and Europe markets — to get around the US imposition of such tariffs.”

QES’s revenue spread is well balanced, averaging 45% from Malaysia, and 55% from Asean and the rest of the world. Furthermore, the geographic spread of the company’s operating subsidiaries across Southeast Asia helps mitigate geopolitical risks.

Currently, the company has minimal exposure to the China market, with less than 3% of its total revenue derived from the region, owing to intense competition from Chinese semiconductor ATE players.

Therefore, the group’s strategy is to work with some of these China-based ATE and equipment players through technical and marketing collaboration and see how it can capitalise on their exposure to the domestic semiconductor market.

Says Chew: “We do have the application knowledge and a certain level of innovation that could make us an attractive partner for Chinese equipment companies seeking a win-win partnership. After all, with our current minimal revenue exposure in the China market, we have little to lose by exploring this new strategy of original equipment manufacturer (OEM)-based technical and marketing collaborations.”

He adds that QES has been using the traditional way of appointing sales distributors or representatives, but such methods have not yielded the desired results over the past four years. He notes that QES also has limited exposure to the US market, as the group’s semiconductor ATE equipment is currently distributed through appointed distributors and representatives.

Interestingly, QES had teamed up with Californian firm Applied Engineering Inc in 2021 to set up a joint-venture company operating in Penang to provide high-tech electromechanical contract manufacturing services.

“If high tariffs are imposed on Malaysian ATE companies, we are prepared to explore the feasibility of manufacturing QES ATE equipment in the US in collaboration with Applied Engineering, to serve customers with facilities in the US,” he says.

Prioritising geographical optimisation

Selangor Information Technology & Digital Economy Corp (Sidec) CEO Yong Kai Ping says Malaysian semiconductor-related firms have significant exposure to the US and China, reflecting the global semiconductor industry’s dependence on these two markets.

While some companies have diversified into Europe and Southeast Asia, he believes greater diversification is needed to mitigate risks from geopolitical tensions. Moreover, expanding into emerging markets and strengthening regional trade networks such as Asean could enhance resilience.

“Malaysian semiconductor players should prioritise geographical optimisation by targeting markets with stable trade policies and fostering partnerships in less volatile regions.

“Strategies could include expanding manufacturing capacity in neutral countries, leveraging regional trade agreements and diversifying supply chains to minimise currency and geopolitical risks,” says Yong.

Another way, he adds, is to leverage the strengths of Malaysia and other nations, combining manufacturing capabilities with front-end semiconductor design expertise.

“This concept is similar to the intention of the Malaysia Semiconductor IC Design Park initiative led by Sidec via a federal-state-private entities-industry collaboration,” says Yong.

The IC design park, situated in Puchong, Selangor, comprises global semiconductor tenants such as MaiStorage, Skyechip, Weeroc, AppAsia ChipsBank and SensoremTek Sdn Bhd, as well as ecosystem partners such as BlueChip VC, ARM Holdings, Cadence Design Systems, Synopsys, Siemens EDA and Keysight, along with the Shenzhen Semiconductor Association.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| APPASIA | 0.130 |

| APPASIA-WA | 0.085 |

| BKAWAN | 19.600 |

| BURSA | 7.810 |

| EDELTEQ | 0.255 |

| ELSOFT | 0.315 |

| FRONTKN | 3.780 |

| GREATEC | 1.680 |

| GTRONIC | 0.435 |

| INARI | 2.010 |

| JFTECH | 0.550 |

| JFTECH-WA | 0.050 |

| KESM | 2.950 |

| KEYASIC | 0.040 |

| KGB | 3.330 |

| MPI | 18.000 |

| OPPSTAR | 0.610 |

| PENTA | 2.920 |

| QES | 0.470 |

| UNISEM | 1.990 |

| VITROX | 2.880 |

Comments