Farm Fresh hits record high — will the stock keep climbing?

This article first appeared in The Edge Malaysia Weekly on November 11, 2024 - November 17, 2024

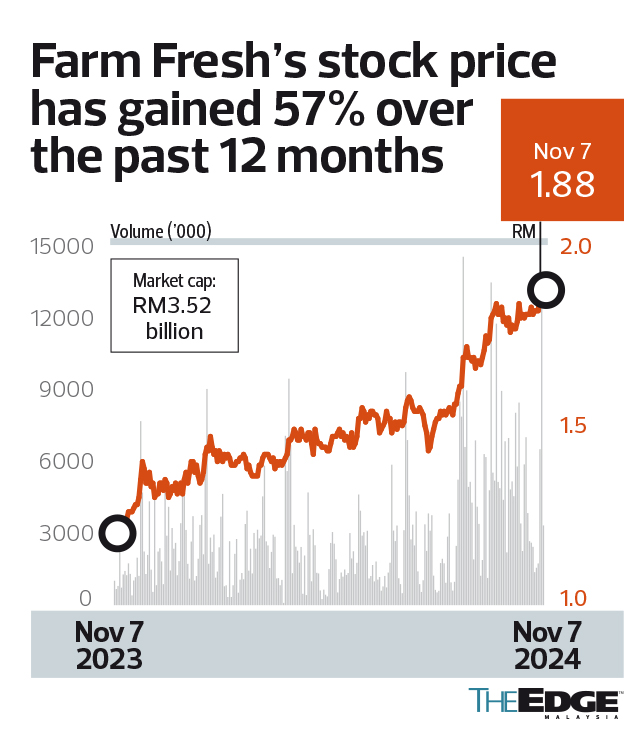

THE share price of Johor-based dairy product specialist Farm Fresh Bhd (KL:FFB) plummeted to a low of RM1.06 in July last year — a sharp drop of 21% from its March 2022 initial public offering (IPO) price of RM1.35.

At the time, investor sentiment was shaken by reports of supply constraints in the Australian milk industry.

Fast forward to this year and Farm Fresh’s shares on the Main Market have staged a powerful comeback, surging 41% year to date and reaching a record high of RM1.88 last Thursday (Nov 7). From its low point to new peak, the stock has rebounded 77%.

What is driving the stock’s momentum and is there still room for growth and upside?

Asked to comment, Farm Fresh co-founder and managing director Loi Tuan Ee tells The Edge that the company’s recent financial and stock price performances are beginning to address investor scepticism.

Reflecting on the challenges posed by the Russia-Ukraine war and cost pressures over the past two years, Loi says, “Our margins compressed for certain quarters last year, but our recovery has shown the resilience of our business.”

Farm Fresh posted strong results in recent quarters, which Loi says has led analysts to raise their ratings. He highlights the fact that even during the tough quarters, Farm Fresh stayed focused on its expansion plans.

“We continued with new launches and acquisitions, such as The Inside Scoop Sdn Bhd and Sin Wah Ice Cream Sdn Bhd, which have been well received,” he says, noting that the acquisitions have extended the company’s reach in the local market.

“When our margins dipped, we didn’t lose market share. We took short-term pain for long-term gain, focusing on sustained growth rather than increasing prices to protect our margins.”

The coming earnings reports are expected to reveal a steady trajectory and further solidify investor confidence.

“Last year, I spent a lot of time explaining to the investors and answering to the shareholders. Now that our earnings have recovered and our share price has rebounded, I guess I can be even more focused on growing our businesses going forward,” says Loi, who wants to build a company for future generations. “I hope investors will see Farm Fresh as a generational wealth investment — a company that builds value over the long term.”

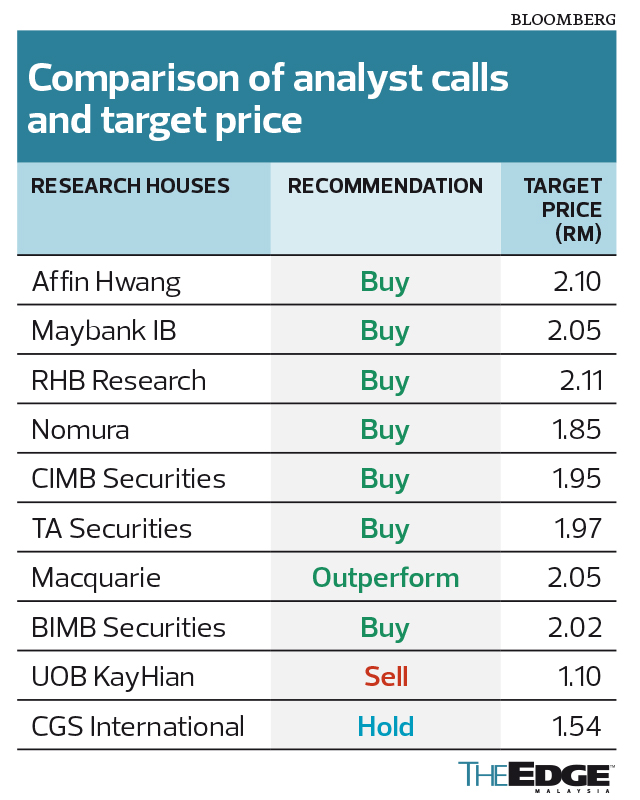

Of the analysts that cover the stock, eight rate Farm Fresh a “buy” or “outperform”, reflecting their confidence in its growth prospects while one analyst has a “hold” recommendation, and another a “sell”. (see table)

At Farm Fresh’s close of RM1.88 last Thursday, its share price has reached the consensus target price of RM1.88, which suggests limited upside potential unless upcoming developments provide fresh catalysts for growth.

Nevertheless, most “buy” calls cluster within the RM1.95 to RM2.10 range, suggesting a moderate upside from current levels.

That said, there is a notable disparity in target prices. The highest, at RM2.11 by RHB Research, implies a potential upside of 12%. This is followed closely by Affin Hwang’s RM2.10, and both Maybank Investment Bank and Macquarie’s RM2.05.

On the other hand, UOB KayHian’s RM1.10 target price — aligned with its “sell” rating — suggests a sharp downside of 41%. Similarly, CGS International’s “hold” call comes with a target price of RM1.54. However, the negative calls could be attributed to the lack of recent updates from the two research houses.

Investors should take note of Farm Fresh’s premium price-earnings ratio (PER) compared with that of other dairy stocks, which may influence investment decisions. Farm Fresh is currently trading at a historical PER of 42 times, placing it in the same premium valuation range as Nestlé (M) Bhd’s (KL:NESTLE) 45 times.

However, its premium is more than twice that of its peers, given Dutch Lady Milk Industries Bhd’s (KL:DLADY) 22 times, Fraser & Neave Holdings Bhd’s (KL:F&N) 19 times and Able Global Bhd’s (KL:ABLEGLOB) nine times.

In an exclusive interview with The Edge in July, Loi had said the dairy group was aiming to capture a larger share of the hotel, restaurant and café market by diversifying its product portfolio and expanding its range of offerings.

In the same month, Farm Fresh launched its own chocolate-flavoured malt product in powder format, in a move to capture significant market share from Nestlé’s Milo, while tapping the local chocolate malt beverage market, which is estimated to be worth RM1 billion.

Through his family’s private vehicles, Loi owns the lion’s share, or 40.22%, of Farm Fresh. Institutional investors include Khazanah Nasional Bhd, the Employees Provident Fund, Kumpulan Wang Persaraan (Diperbadankan) and Abrdn Malaysia Sdn Bhd.

Lower cost and product expansion

Farm Fresh posted a 27% rise in earnings to RM63.53 million in the financial year ended March 31, 2024 (FY2024), up from RM50.08 million in FY2023.

The increase in profitability was driven mainly by a reduction in the input cost of dairy raw materials and the positive impact of an increase in the price of chilled ready-to-drink products and certain ultra-high-temperature products in Malaysia that took effect from mid-July 2023, as well as contributions from its newly acquired The Inside Scoop and Sin Wah Ice Cream.

Earnings continued to rise as Farm Fresh reported a net profit of RM25.99 million in the first quarter ended June 30, 2024 (1QFY2025). On an annualised basis, this quarterly performance suggests that the company could potentially achieve an annual profit of RM103.96 million for the full financial year, assuming consistent earnings across subsequent quarters.

According to the three most recent reports by Maybank IB, RHB Research, and Affin Hwang, Farm Fresh is projected to achieve a profit of between RM104 million and RM113 million in FY2025, with further growth to between RM137 million and RM146 million anticipated in FY2026.

Its current market capitalisation of RM3.5 billion gives Farm Fresh a prospective PER of 31 to 34 times for FY2025 and 24 to 25 times for FY2026, based on forecast earnings.

Farm Fresh’s surging share price is being driven by a few key factors, according to Ng Tzyy Loon, portfolio manager at Tradeview Capital.

“First, it is definitely that raw milk cost has come down over the past few quarters and seemed to stabilise in the previous two to three quarters, which helped provide clarity on its future earnings,” he tells The Edge.

Ng also notes the company’s expansion into new product categories, such as butter, formula milk and ice cream, extending its reach beyond dairy beverages.

The potential for further upside, he believes, depends largely on the upcoming quarterly results. “If the management is able to convince investors of the growth in its new products, including ice cream and The Inside Scoop, there is a chance that analysts will revise their target prices for Farm Fresh.”

Acknowledging that stock valuation-wise, Farm Fresh appears to be expensive, Ng points out that apart from PER, investors should also consider other factors.

“Investment is more an art than science, in my view. Therefore, we need to ask ourselves how we should evaluate Farm Fresh. Do we see it as just an ordinary dairy goods company?

“Or should we see it as a company that will gain more presence in the local food and beverage consumer market? Or even view it as a company championing the Malaysian brand with the potential to expand overseas?”

In addition, Ng refers to the strong institutional support for Farm Fresh, particularly from Khazanah.

“In the light of the controversy surrounding the FashionValet case, I think Farm Fresh is one of the best, if not the best, domestic investment that Khazanah has made in the last 10 years. Hence, it definitely has strong support from the local institutions,” he says.

Rakuten Trade Sdn Bhd head of equity sales Vincent Lau concurs that Farm Fresh is currently in a sweet spot with lower raw material costs and more new product offerings.

“As a regular consumer myself of their chocolate milk and The Inside Scoop ice cream, I think Farm Fresh has found a blend of quality and reasonable price point.”

Lau believes there is still upside for Farm Fresh’s share price, especially considering its valuation relative to Nestlé’s. “The simple average PER of Nestlé and Dutch Lady is 33.5 times. The better comparison, in fact, is Nestlé, as it would be more similar to Farm Fresh given its broad product offerings, whereas Dutch Lady is producing mainly milk products.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments