Insider Moves: Bintai Kinden Corp Bhd, Dataprep Holdings Bhd, Leong Hup International Bhd, Frontken Corp Bhd, Globetronics Technology Bhd, Sarawak Cable Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on January 15, 2024 - January 21, 2024

Notable filings

From Jan 2 to 5, notable shareholding changes at Bursa Malaysia-listed companies included those at Bintai Kinden Corp Bhd, which saw its non-executive chairman Datuk Ng Choon Koon increase his stake by three million shares to 6.19%. Ng was state assemblyman for Bemban, Melaka, from 2013 to 2018.

The Practice Note 17 (PN17) company, which is engaged in mechanical and electrical engineering, construction and concession arrangements, announced on Jan 2 that it had accepted the conditional relief indulgence (CRI) and was working towards restructuring its financial liabilities with MBSB Bank Bhd. Both parties had agreed to withdraw their legal suit against each other following the acceptance of the CRI and conditions to be fulfilled by Jan 10. Bintai also said it was formulating a regularisation plan and would “spare no effort” to exit its PN17 status within the regularisation period.

Over at Dataprep Holdings Bhd, Tan Sri Muhammad Ikmal Opat Abdullah, founder of Widad Business Group, disposed of 16 million shares in Dataprep through Wardah Communications Sdn Bhd. Post-disposal, he holds 58 million shares, or a 7.86% stake, in the IT company.

In December last year, Dataprep announced a proposal to acquire 70% equity interest in DACS Network Solutions Sdn Bhd (DNS) from Cloudaron Group Bhd for RM10.5 million, to be satisfied by the issuance of 82.68 million Dataprep shares at 12.7 sen apiece. DNS is principally involved in the provision and management of network connectivity services, operating as a telecommunications industry dealer, whereas Dataprep offers consulting and IT services to governments and industries.

At Leong Hup International Bhd, Clarinden Investment Pte Ltd disposed of 12.26 million shares in the poultry player on the open market, according to filings with Bursa. Post-disposal, Clarinden is left with a 6.94% stake in Leong Hup.

In December 2023, Leong Hup’s subsidiary Leong Hup Feedmill Malaysia Sdn Bhd along with four other feed millers were slapped with a RM415.5 million fine by the Malaysia Competition Commission (MyCC) for allegedly colluding in a “chicken feed cartel” to fix poultry feed prices. Leong Hup recently appealed against the MyCC decision to fine its subsidiary RM157.47 million.

Ooi Keng Thye ceased to be a substantial shareholder of Frontken Corp Bhd after disposing of 4.41 million shares in the company during the week in review, according to filings with Bursa. He has been paring down his stake in Frontken and is now left with 4.97%. The largest shareholder of Frontken is Dazzle Clean Ltd with 16.79%, followed by the Employees Provident Fund (EPF) with 9.76%.

Notable movements

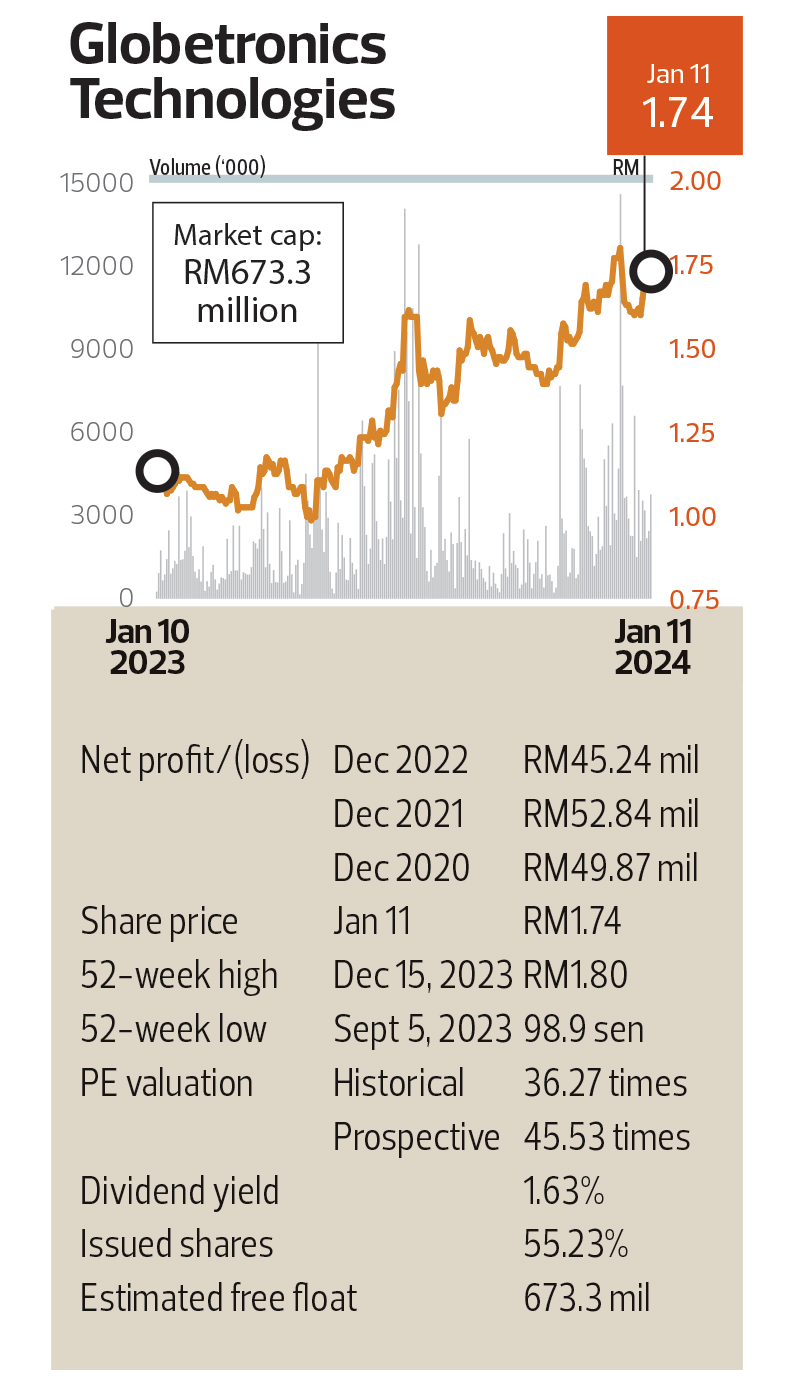

While Ooi was paring down his stake in Frontken, he was increasing his shareholding in Globetronics Technology Bhd. Filings with Bursa show that he raised his stake in the semiconductor company by 1.98 million shares during the week in review, bringing his total shareholding to 53.19 million shares, or 7.9% equity interest.

During the week, Globetronics’ share price increased 8.1% to RM1.73 from RM1.60. On Dec 15, the stock had hit RM1.80 amid talk that the founding family of the Penang-based company was looking to divest its stake.

The Ng family has confirmed that it is selling 70 million shares, or 10.41% equity interest, to APB Resources Bhd for RM140 million cash. Upon completion of the share acquisition, APB Resources will emerge as the second-largest shareholder of Globetronics behind EPF, which has a 14.37% stake, while Ooi will be the third-largest shareholder with 7.9%.

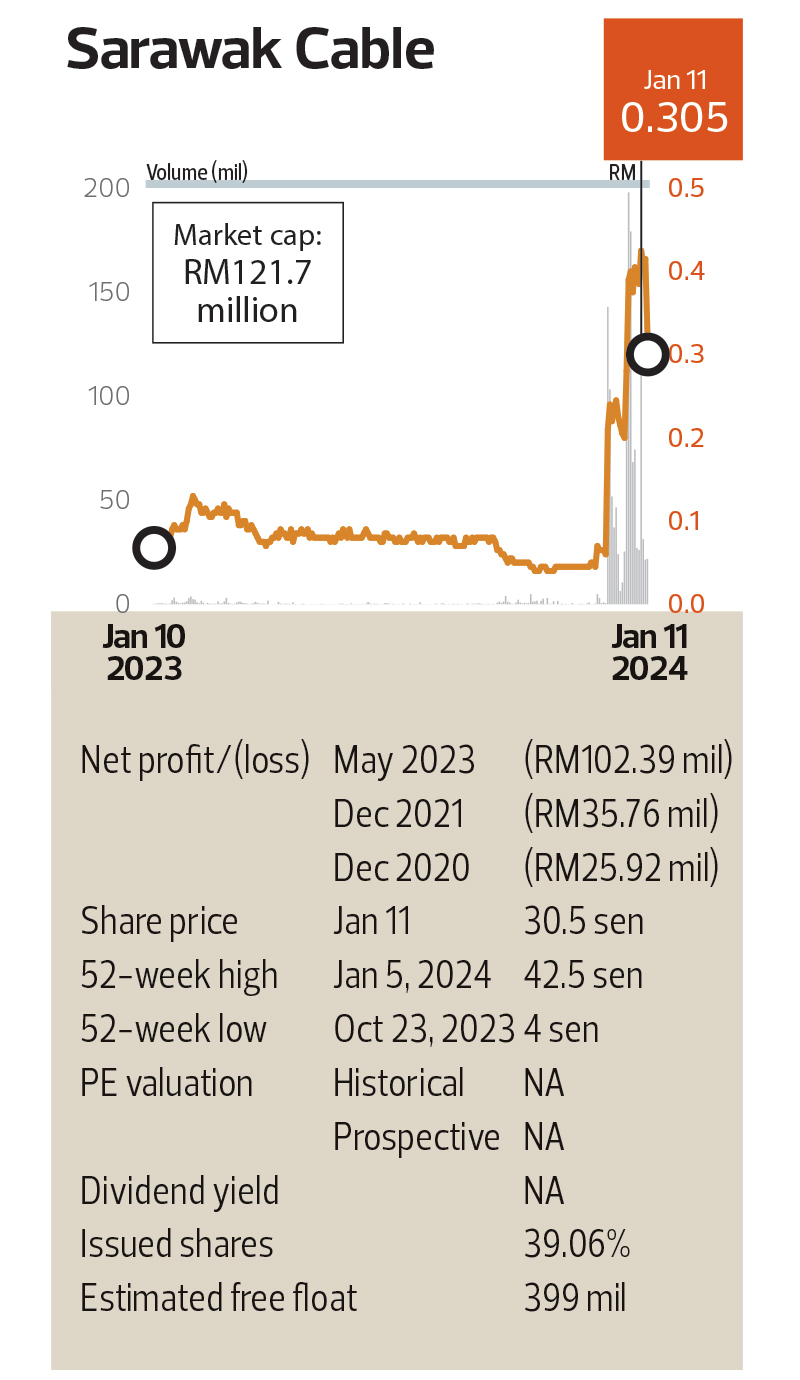

Sarawak Cable Bhd’s (SCable) share price increased sevenfold between Dec 11 and Jan 5, surging from 6 sen to 42.5 sen. Filings with the stock exchange show that HNG Capital Sdn Bhd had disposed of 1.79 million shares in the company on the open market. Post-disposal, HNG is left with a 7.37% stake.

The share price surge followed Serendib Capital Ltd’s offer to resuscitate SCable through a mix of debt repayment and working capital injection of RM250 million. The latter was classified as a PN 17 company in September 2022 after its external auditor flagged uncertainty on the company as a going concern.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| APB | 1.880 |

| BINTAI | 0.080 |

| BURSA | 7.460 |

| CLOUD | 0.050 |

| DATAPRP | 0.140 |

| FRONTKN | 3.890 |

| LHI | 0.575 |

| MBSB | 0.780 |

| SCABLE | 0.160 |

Comments